Image source: Getty Images

For investors looking to build long-term wealth, there are some terrific opportunities in UK growth stocks right now. Or at least, that’s what some analysts think.

Even the best companies run into temporary difficulties every so often. And when they do, it can be a good time to take a look at them as potential buying opportunities.

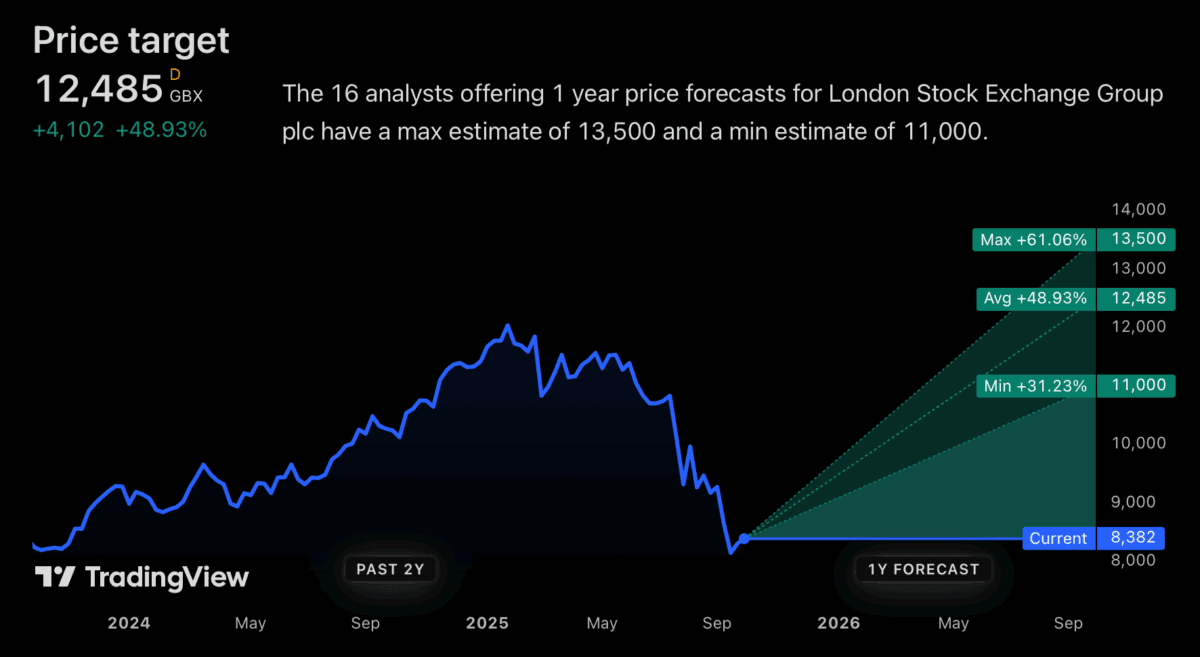

London Stock Exchange Group

The average analyst price target for The London Stock Exchange Group (LSE:LSEG) is around 50% above the current share price. And the lowest is almost 33% higher.

It’s easy to see why. The company has some very strong stock market data and management is talking positively about the future outputs from its partnership with Microsoft.

Investors, however, need to be careful. According to Goldman Sachs, over 42% of S&P 500 firms mentioned AI in their earnings reports from a year ago, but some are more convincing than others.

I think the worst stocks to buy right now are ones that look like AI winners but in fact are not. And this seems to be the market’s view of London Stock Exchange Group at the moment, with the stock down 28% this year.

The stock is trading at a price-to-earnings (P/E) ratio of 20 based on next year’s forecasts. That’s a lower ratio than usual, but Annual Subscription Value (ASV) growth has been slowing recently.

Given this, I think the stock is riskier than it looks. A number of businesses that have seen AI as an opportunity have found it to be more of a threat. It’s still not clear to me whether London Stock Exchange Group is one.

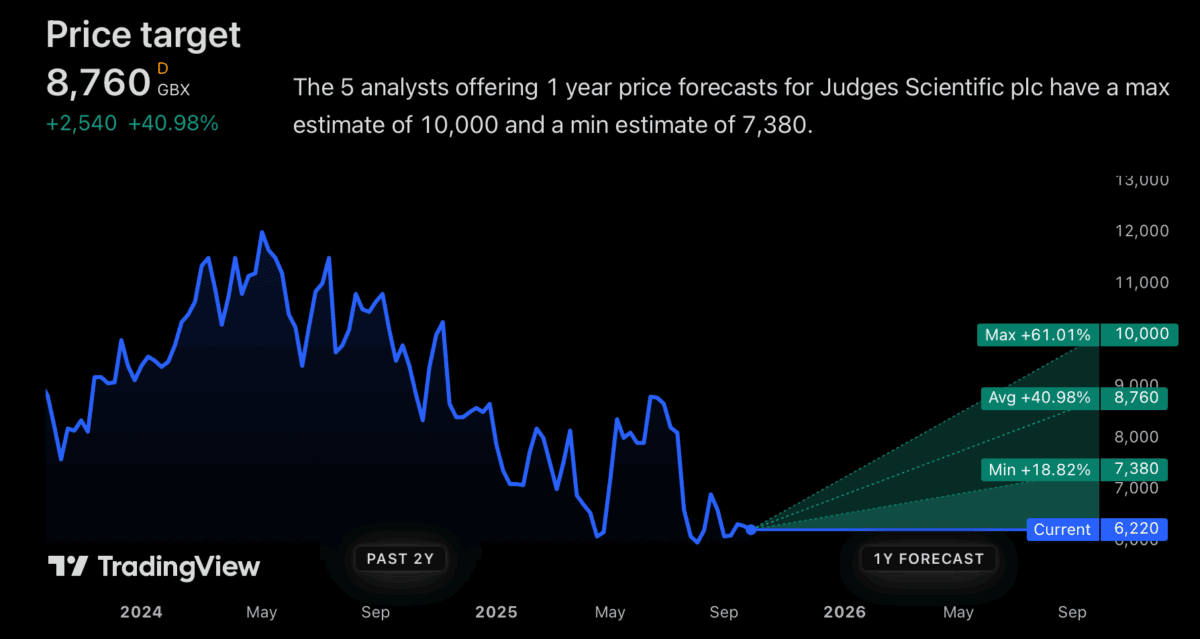

Judges Scientific

Judges Scientific (LSE:JDG) doesn’t attract as much attention as LSEG. But the analysts who are looking at the stock have a very positive view of where it ought to be trading.

The firm’s business model is built around acquiring scientific instrument companies and helping them grow. This can involve contributing commercial expertise, scale, and capital.

Judges Scientific operates a decentralised approach. This allows subsidiaries to remain agile and responsive to customer needs, but it does come with certain risks.

The most significant is that it means going without the savings that come from fully integrating new operations. And this increases the danger of overpaying for acquisitions.

The company’s size, however, helps offset this risk. Being relatively small means there are usually opportunities that can boost its growth without being large enough to attract major competition.

Coincidentally, the stock is also down 28% since the start of the year. But I think this is largely due to short-term macroeconomic challenges, making this a great time to consider buying the stock.

Buy low?

Both the London Stock Exchange Group and Judges Scientific are down 28% since the start of the year. And there’s a decent case to be made for buying either of them.

My own view, however, is that I prefer Judges Scientific. I think I have a much clearer sense of its future prospects than I do with LSEG.

I could be mistaken, but that’s one of the nice things about growth investing. Even if investors miss a few opportunities, it only takes a few great investments to achieve outstanding results.