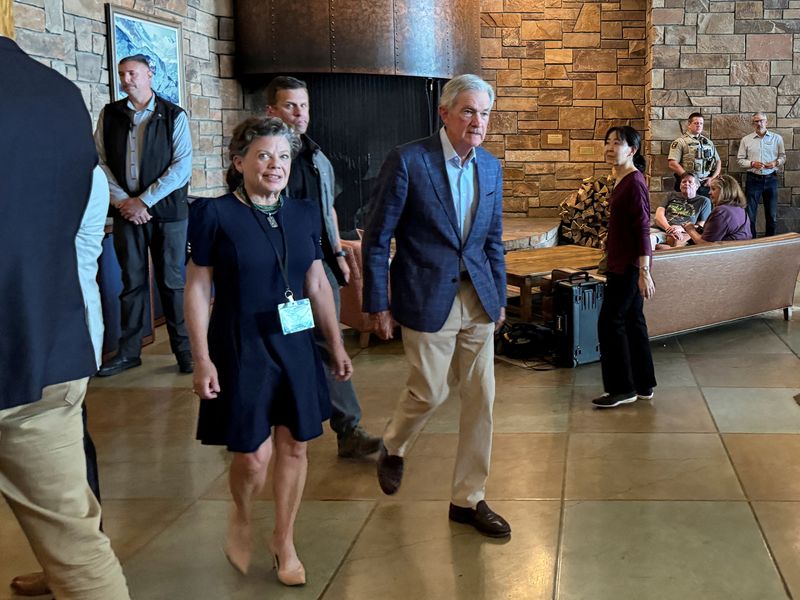

NEW YORK (Reuters) -U.S. Federal Reserve Chair Jerome Powell on Friday pointed to a possible rate cut at the central bank’s September meeting but stopped short of committing to it in remarks that walked a narrow line acknowledging growing risks to the job market while also saying risks of higher inflation remain.

“While the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers,” Powell told an audience of international economists and policymakers at the Fed’s annual conference in Jackson Hole, Wyoming.

MARKET REACTION:

STOCKS: U.S. stocks extended gains after Fed’s Powell’s remarks.BONDS: U.S. Treasury yields dropped as Fed’s Powell alluded to rate cuts.

FOREX: The dollar fell after Powell’s comments.

COMMENTS:

ART HOGAN, CHIEF MARKET STRATEGIST, B RILEY WEALTH, NEW YORK:

“Chair Powell was able to talk about the balance of risk shifting and therefore the potential of shifting of policy would be appropriate. That’s a clear hint that Chair Powell is open to supporting rate cuts in the future, likely in September, again in October and then again in December. So, leaning into the fact that the labor market weakness is clearly the driver as opposed to concern over the core goods price increases that we’ve seen because of tariffs…The clear message to the market is September is now very live.”

BRIAN JACOBSEN, CHIEF ECONOMIST, ANNEX WEALTH MANAGEMENT, BROOKFIELD, WISCONSIN: VIA EMAIL

“The Fed isn’t going to be the party-pooper. Chair Powell has shown he has an open-mind to reading the data tea leaves. The downside risks to the labor market have risen and while they are still worried about inflation expectations, they aren’t going to prioritize the unknowable inflation expectations risk over the known risks to growth.”

(Compiled by the Global Finance & Markets Breaking News team)