Bust out the record collection. Not only might it be worth something, there’s a valuable retirement lesson in there, too.

Since the launch of Record Store Day in 2008, vinyl has made a serious comeback. How big? In 2022, vinyl outsold CDs for the first time since 1987, racking up more than $1 billion in sales. A key reason why records are hip once again is cultural nostalgia.

And that’s not the only thing people are nostalgic for these days. An overwhelming number of workers would happily rewind to the era of pensions. According to a recent Nuveen and TIAA Institute survey, 93% of 401(k) plan participants said it’s important to have the option to convert their savings into guaranteed monthly income. Two-thirds said that option would make them feel more confident about retirement.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

The survey highlights one of the biggest challenges in retirement: figuring out how to turn your savings into a steady income stream, so you can enjoy life today without losing sleep about tomorrow.

Because, much like a vinyl record, retirement for most has two distinct sides. It starts with high energy, then flips to something slower — each with its own rhythm, needs and funding decisions.

To understand what retirement really looks like, and why it’s not one continuous groove, consider the vinyl rule of retirement: plan to make the most of the active, high-energy early years while preparing for the slower, care-focused side that comes next.

Side A: The active, adventurous retirement years

An Allianz survey found that the top aspirations for retirement are to “pursue new hobbies” and “find new adventures.” For many, that happens during the first decade.

“This is when people check off the bucket-list items they’ve been dreaming about their whole lives,” says Jacob Martin, CFP® and financial adviser at Keeler & Nadler Family Wealth. “I often see clients move to a new city, travel the world and generally make the most of their physical health while they still can.”

Spending tends to reflect that burst of activity. JP Morgan research shows that Americans with $1-3 million in investable assets typically hit their peak spending years in midlife and into early retirement, but often see a dip before spending rises again later in life due to health care needs.

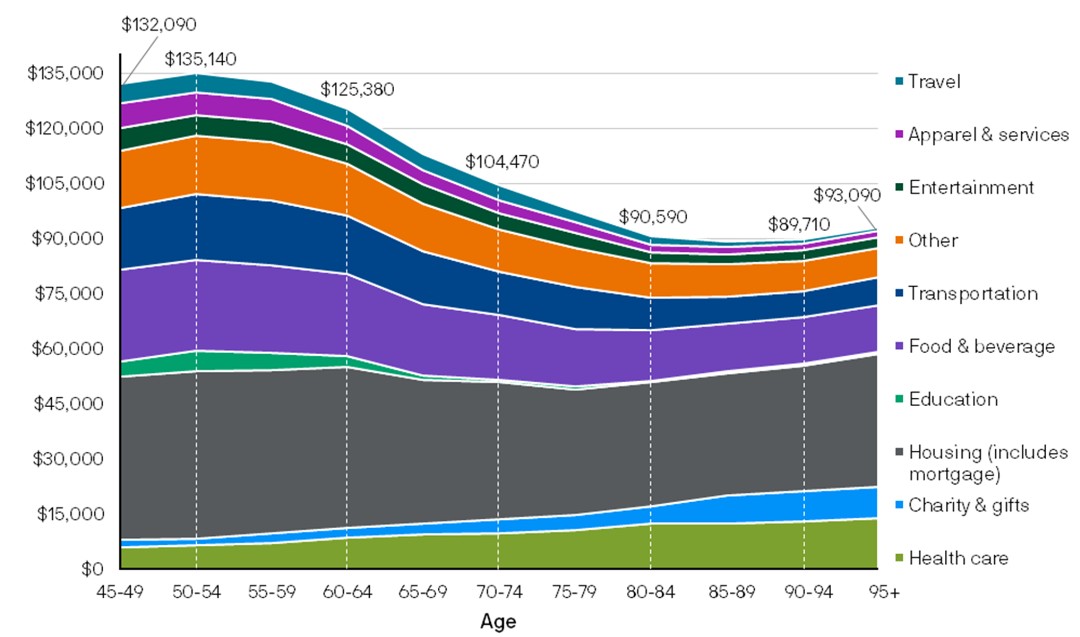

The chart below illustrates the annual spending by age in households with investable wealth ranging from $1 to $3 million.

(Image credit: JP Morgan, Guide to Retirement, 2025. • Changes in Spending HHolds With $1 to $3M)

That’s why Martin encourages clients to embrace this early phase. “Some retirees hold back, thinking they’ll spend more later. But this is the decade to really live. Spending more from 65 to 75 often works just fine since costs usually drop later.”

His recommendation? “Set up a regular withdrawal from your investments, like a paycheck, to create a sense of consistent cash flow so you feel confident spending on the things you care about.”

Ralph White, principal and financial planner at Arrivity Financial Planning, suggests creating separate pools of money for different goals. The first is a traditional retirement portfolio invested in a diversified mix of stocks, bonds and two years’ worth of cash reserves for steady spending needs.

Then, do something similar for your active retirement years. “Since this is such a finite period of time, I don’t want market downturns to impact this because you can’t get this time back,” he says. “I recommend setting aside funds that are available specifically for travel or other fun activities, ideally in a separate savings or conservatively invested brokerage account.”

(Image credit: Getty Images)

The flip: easing into the next chapter

Eventually, the tempo slows. There’s a gradual shift in retirement, moving from adventure and activity to a quieter, more reflective rhythm. This transition can stem from changes in health, evolving priorities or the reality of a shrinking budget.

According to Martin, this “slower phase” tends to emerge between ages 75 and 85. “This is when I start to see health become a limiting factor,” he says. “Big trips and active pursuits become harder to manage. Even if outside care isn’t yet needed, spending tends to drop and bottom out around age 80.”

That shift is rooted in biology as much as lifestyle. For example, research indicates that after age 30, strength declines by 10% to 15% per decade until around age 70, when the loss accelerates to 25% to 40% per decade.

That means even daily routines may require more energy or assistance, nudging retirees toward lower-intensity activities, like river cruises instead of hiking tours, or evenings out over long-haul adventures.

This transition doesn’t have to catch you off guard. Planning for “the flip” means making sure your assets can go the distance, especially with inflation eroding your spending power over time.

One key move is thinking carefully about when to claim Social Security, says Bill Shafransky, CFP® and senior wealth adviser at Moneco Advisors. “Taking your benefit before full retirement age results in a permanently lower monthly payment,” he says. “That smaller base means future cost-of-living adjustments (COLAs) will also be smaller, which can add up over time.”

Still, none of this means the music stops.

Side B: slower, quieter — but still rich with meaning

Just like flipping a record, the later years of retirement offer a different tempo — slower, softer, more reflective. But they’re not any less meaningful or even less expensive.

In fact, spending can rise again during this stage, largely due to increased health care and potential caregiving needs. A 65-year-old retiring in 2025 can expect to spend an average of $172,500 on health care over the course of retirement, estimates Fidelity.

It explains why two in three workers (66%) say they’re worried about their health as they age. And for good reason: Genworth’s 2024 Cost of Care Survey pegs the national median annual cost of assisted living at $70,800.

Not everyone will require long-term care, and there are different ways to fund it. However, Martin advises people to consider long-term care insurance to help cover later-life expenses. “If you’ve planned for healthcare needs on the back end,” he says, “you can feel more comfortable spending freely during your earlier, more active retirement years.”

Shafransky sees this as a blind spot for many clients. “What I find interesting is how optimistic some pre-retirees are about the latter years,” he says. “They think, ‘That won’t happen to me.’ But even if long-term care insurance isn’t the right fit, it’s essential to have a financial strategy for a worst-case scenario.”

Thriving on “Side B” isn’t just about finances, as non-financial preparation can also make a big difference in your quality of life. Research indicates that people with a sense of purpose experience less cognitive decline. Regular volunteering is linked to slower biological aging, and staying mentally and socially engaged can help stave off depression, loneliness and memory loss.

And, of course, regular exercise remains one of the most effective tools for aging well.

Still, these are years worth looking forward to, as older adults tend to be happier than their younger counterparts. Research shows that with age comes greater emotional resilience and contentment, as older adults tend to live more in the present, appreciating time rather than constantly planning for what’s next.

It goes to show the vinyl record resurgence may also signify the value of being “old school” like that. As John Lennon (who had a custom record player installed in his Rolls-Royce) famously said: “Life is what happens when you’re busy making other plans.”