Are you happy with your online tool or app for retirement planning? If you’re like most people, the security of that app is as important as its navigation speed or visual appeal. That’s the finding from a recent J.D. Power study on how consumers view the digital experience when using mobile or online tools for retirement planning.

Many of these tools act as “data aggregators,” linking to your financial accounts at different institutions for the latest balance and investment information. The result is a helpful picture of your assets and portfolio construction in one place. Achieving that clarity, however, means that you need to trust the app with the log-in credentials of your other accounts — making those tools a tempting target for scammers and hackers.

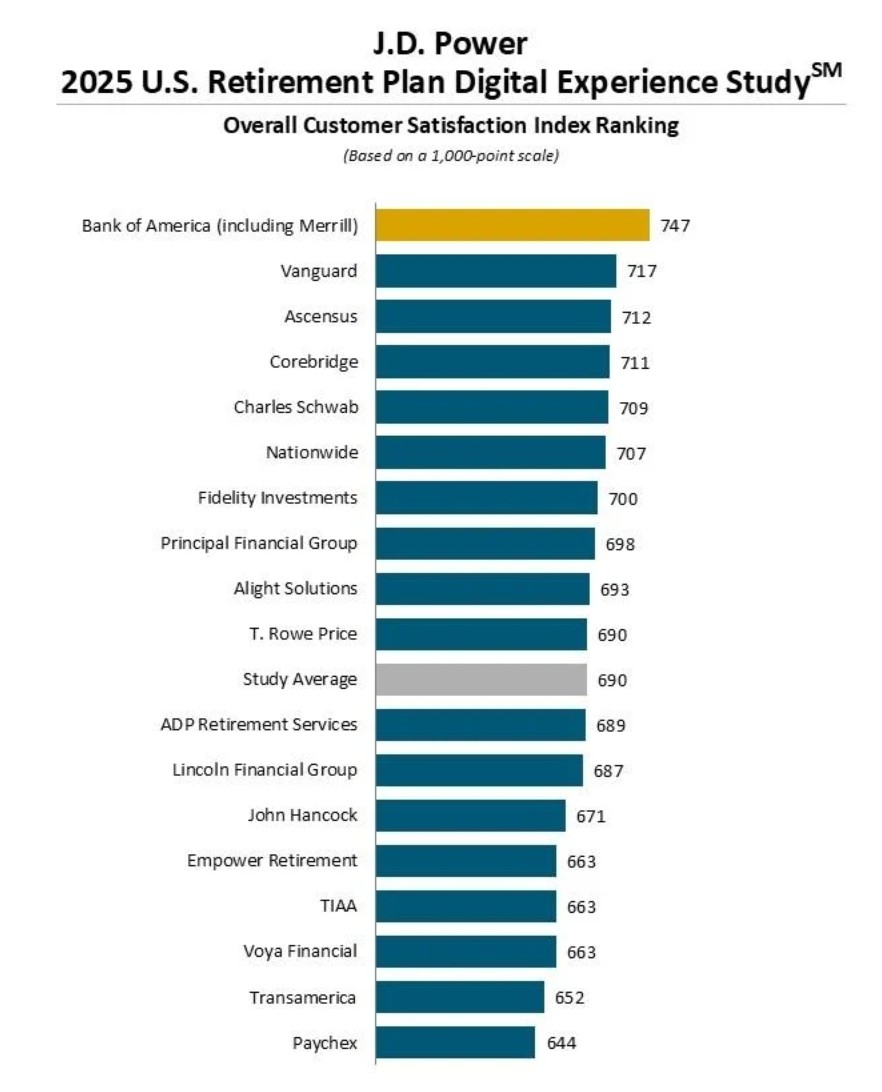

The J.D. Power’s 2025 U.S. Retirement Plan Digital Experience Study benchmarked 18 major banks and financial institutions based on a large survey of U.S. consumers. So, did your retirement platform earn a high score?

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Security is king when using retirement planning apps

Retirement plans are, obviously, valuable assets worth protecting, and it is clear that those turning to mobile planning apps want to ensure that the apps themselves are secure. As a result, there has been a shift in focus from app users prioritizing convenience to ensuring that these programs are as safe as possible.

“There was a time not long ago when multifactor authentication processes and other digital security measures were dismissed as an annoyance by website and mobile app users,” a recent J.D. Power report said. “Now, enhanced security is one of the most critical pieces of the retirement plan digital experience.”

Following recent high-profile data breaches, including the 2017 Equifax breach that exposed the data of 147 million Americans, it’s not surprising that those who use mobile apps to monitor their retirement accounts would want to ensure that no unauthorized individuals can unlawfully access their plan.

The best (and worst) apps for retirement planning

J.D. Power asked retirement plan users about their attitudes towards digital apps in general and assessed which apps had the highest customer satisfaction. Scores were out of a total possible 1,000 points. Here’s how the 18 financial institutions ranked, where a high score is best.

(Image credit: J.D. Power 2025 U.S. Retirement Plan Digital Experience Study™. Rankings based on numerical scores and not necessarily on statistical significance.)

The study measured customer satisfaction across four areas: design, system performance, tools and capabilities and finally, the quality of information provided. The study is based on responses given by 7,151 plan participants in 2025.

For those stuck with a bad retirement planning tool, switching to a different institution’s platform might make sense. Yes, it will be painful in the short-term to transfer all of those account credentials, but if you feel the security and user experience is better, you’ll be more likely to actually use the app. Just be sure you know what happens to your data when you move it off a given system; you might call customer service to make sure your information has been deleted. Make sure you have opted out of data sharing and de-linked financial accounts where possible.

Remember that the J.D. Power study is just one measure of these tools’ usefulness. You should also consider whether they require you to establish a retirement account (in which case, fees and terms are important). Working with a financial adviser with a retirement planning focus is another to set pick a platform. Note that advisers often use their own industry software, such as MoneyGuide and eMoney.

As sophisticated as these platforms are, AI will jump start new innovations in how you work with your financial data. AI is already helping companies protect against security breaches — and making companies and their customers more vulnerable at the same time.