Image source: Getty Images

The number of people using Individual Savings Accounts (ISAs) to buy shares is rising. But not everyone saving or investing in these tax-efficient products is guaranteed to make a nice pile of cash over time.

Here are three steps that ISA users can take to help substantially grow their wealth.

1. Set clear goals

Before filling up a Stocks and Shares ISA, it’s critical to consider what you’re trying to achieve. This will influence every facet of an investing strategy.

Someone looking to build a retirement fund is likely to have time on their side. As a consequence, they might want to consider prioritising growth stocks, which, while volatile, can deliver exceptional long-term returns.

Conversely, an individual who’s seeking to fund their child’s education may have less than a decade to build their ISA. In this instance, they may want to balance riskier, high-growth shares with more defensive stocks like utilities. They may also want to hold some money back in a Cash ISA.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

2. Be patient

We all love the idea of getting rich overnight. But taking a ‘Hail Mary’ approach with high-risk assets rarely works. In fact, it can leave individuals nursing a large hole in their pockets.

In reality, discipline, patience, and a measured risk-reward strategy tend to be the most powerful weapons for targeting life-changing returns.

Charlie Munger, who was right-hand man to Warren Buffett for 45 years, said, “the big money is not in the buying or the selling, but in the waiting“. With this approach, investors can let the power of time and compound returns do the heavy lifting for them.

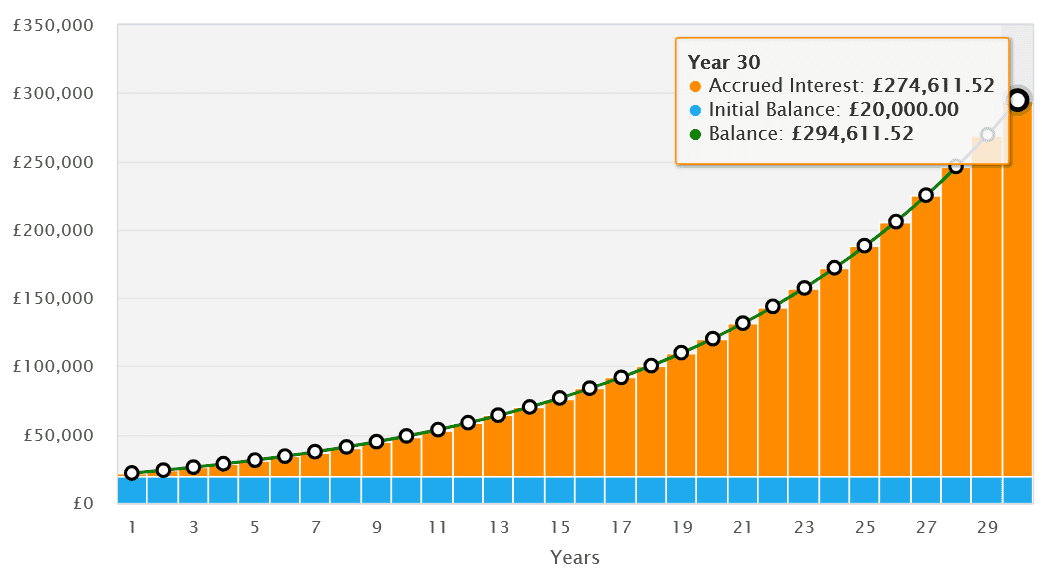

A £20,000 lump sum investment might not seem much. But left to compound at an annual rate of 9%, a modest nest egg like this could eventually turn into almost £300,000 after 30 years.

3. Build a diversified ISA

ISA investors have thousands of shares, investment trusts, and funds from across the globe they can buy to target strong returns. It can pay to take full advantage of this.

Having a diversified portfolio provides exposure to a wide range of growth and income opportunities. It also helps individuals reduce risk. I personally like the idea of having an ISA of at least 20-25 stocks whose operations span industries and regions.

This can be done by buying individual shares, though trusts like Alliance Witan (LSE:ALW) can also be used to effectively diversify.

This FTSE 100-listed investment trust relies on a team of 11 fund managers to select a maximum of 20 shares. This provides a wide range of perspectives that draws on decades of investing expertise.

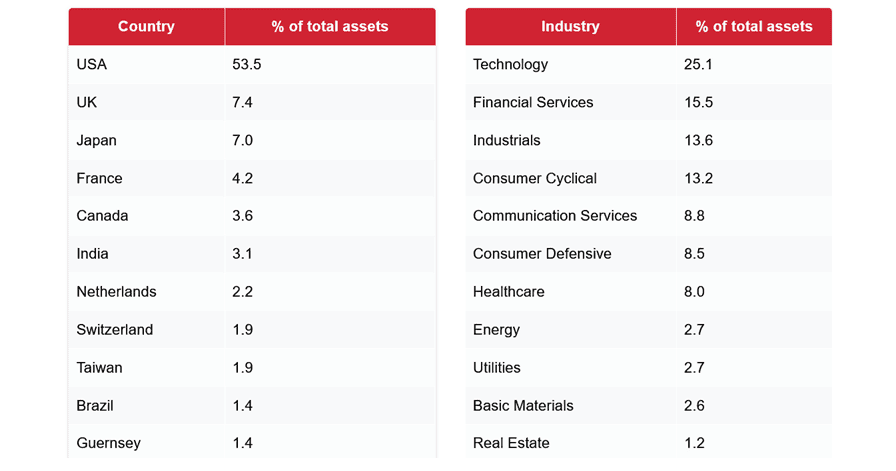

Today, Alliance Witan holds shares in 223 different companies spanning a range of sectors and covering all four corners of the globe:

Its portfolio is packed with multinational companies, offering further strength. And many of these are tech giants like Microsoft and Nvidia, which — although leaving the trust vulnerable to economic slowdowns — opens the door to significant long-term returns as the digital economy explodes.

Alliance Witan has delivered an average annual return of 11.6% since 2015. If this continues, which of course is not guaranteed, it could go a long way to helping an ISA investor generate substantial wealth.