Image source: Getty Images

Palantir Technologies (NASDAQ:PLTR) stock joined the S&P 500 in September 2024. But just 16 months before then it was trading for $7, and looked more likely destined for semi-obscurity than the prestigious blue-chip index.

Fast forward to today, Palantir stock has skyrocketed to around $145. For those keeping score, that’s an eye-popping gain of almost 1,900%!

Clearly, anyone who invested just under three years ago has made out like a bandit. They might even be a paper millionaire, depending on whether or not they backed up the truck.

But the question now is, can this high-calibre growth stock still potentially create future millionaires?

Another blowout quarter

As a quick reminder, Palantir helps governments and businesses make sense of their messy data to improve efficiency and produce better decisions. Its Artificial Intelligence Platform (AIP) connects AI with data, driving automation across various real-world operations.

The firm’s customers range from dozens of blue-chip companies to the FBI, CIA, and NHS. And in Q4 2025, its customer count grew 34% year on year, as it closed 180 deals valued at no less than $1m, 84 deals of at least $5m, and 61 at $10m or more.

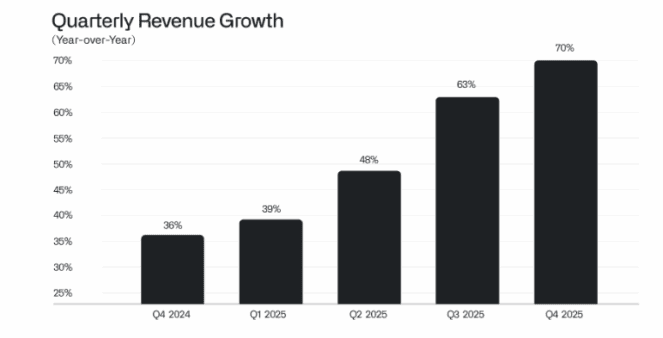

Revenue exploded 70% higher to $1.4bn, marking an uptick in the growth rate. Indeed, this trend has been accelerating like a runaway train for five consecutive quarters now.

Palantir’s AIP business is driving truly incredible growth, with US commercial revenue surging 137% to $507m. Meanwhile, government revenue jumped 66% to $570m.

Equally remarkable is Palantir’s profitability. In Q4, it generated net income of $609m, representing a red-hot 41% margin. Never one to miss an opportunity to blow Palantir’s own trumpet, colourful CEO Alex Karp called this record profit “pure and uncontrived“.

In contrast, he said other enterprise software firms “may feel pressure to manage their businesses around their financials“. I read that as a dig at competitors who are carrying out acquisitions to buy revenue and ready-built AI products.

Then again, Karp doesn’t see Palantir as having any rivals. He wrote: “We are an n of 1, and these numbers prove it.”

Millionaire-maker?

This quarter once again confirmed that we’re looking at a once-in-a-generation growth company. For 2026, it sees revenue increasing by another 61% to around $7.19bn.

Looking ahead, I can only see the company getting larger. Because once an organisation’s operations are plugged into Palantir’s platforms, it’s incredibly unlikely to leave.

Indeed, the opposite is happening — firms and agencies are becoming more reliant on the company. As such, the chief executive argues Palantir should be judged differently by the market.

To some extent, I agree with this. After all, the company is putting up extraordinary numbers and is extremely profitable. That deserves a premium.

But how much? Using this year’s forecast, the stock’s price-to-sales ratio is approaching 50, while the forward-looking earnings multiple is above 100. This leaves no margin of error for any sort of unexpected slowdown in growth, which is also extremely US-centric.

In my opinion, the stock remains overvalued, even after falling 32% since November. With an already hefty market cap above $300bn, I don’t see Palantir as a millionaire-maker today.

Nevertheless, if the stock keeps falling, I may become interested. But for now, it remains on my watchlist.