An unproven small launch startup is partnering with a severely depleted SPAC trust to do the impossible: go public in a deal they say will be valued at $400 million.

Innovative Rocket Technologies Inc. (iRocket) and BPGC Acquisition Corp., a special purpose vehicle company founded by former Commerce Secretary Wilbur Ross, is aiming to close the transaction in the fourth quarter of this year.

Interestingly, the SPAC has been depleted of most of its cash after it raised $345 million in its IPO in March 2021. According to a September 2024 filing with the U.S. Securities and Exchange Commission, the SPAC had returned much of its money to shareholders when it failed to find an acquisition target by September 2024 and held $30.5 million in trust.

However, just 16 days later, the company reported in an 8-K that another $28.8 million had been redeemed — leaving the trust as of that date with just 0.5% of its original amount, or $1.6 million. The remaining shareholders (primarily the SPAC’s sponsors) agreed at that time to extend the date to find an acquisition target to March 2026.

The startup, iRocket, was at one time buzzy because it was backed by venture capital firm Village Global, which counts billionaires like Bill Gates, Eric Schmidt, and Reid Hoffman among its limited partners.

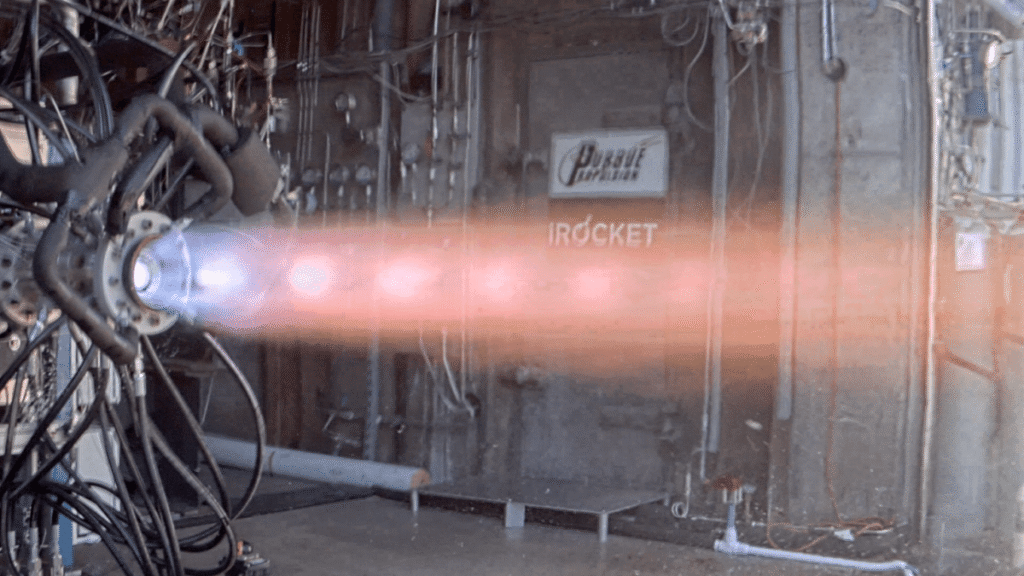

Even still, iRocket is a surprising target for a take-public deal. The company has raised only a few million in venture funding, according to PitchBook, in an industry that is known for being extremely capital intensive. Since its founding in 2018, it has yet to conduct a single test flight of its Shockwave launch vehicle. In that time, it has been overtaken by other firms, like Stoke Space and Firefly, that are better capitalized and farther along in their hardware development.

The market has changed, too: As of 2023, iRocket described Shockwave as being able to carry 300 kg to 1,500 kg payloads, and that space has become crowded with vehicles like Firefly’s Alpha and Rocket Lab’s Electron, both of which have flown customer payloads. If iRocket can prove out the rest of its value proposition — full reusability, rapid refurbishment, and 24-hour responsiveness — it could prove very competitive, but that’s a tough series of goals.

Techcrunch event

San Francisco

|

October 27-29, 2025

The New York-based startup lists just four employees, excluding board members, on LinkedIn. Its contracts include an $18 million deal with the Air Force Research Lab and a $1.8 million contract with the Space Force. A PR firm representing iRocket and the SPAC declined to respond to TechCrunch’s questions.

The special purpose acquisition vehicle has a checkered past. Operating under the name Ross Acquisition Corp II, it tried to take public biopharma company Aprinoia Therapeutics in January 2023 but terminated the deal eight months later. After failing to consummate a transaction, the NYSE subsequently commenced delisting proceedings against the SPAC last March.

RAC II changed its name to BPGC Acquisition Corp. and now has until March 2026 to close a deal.

But given the SPAC’s current cash reserves, if iRocket’s existing shareholders expect to be paid much cash for their equity, the two parties will need to pull in a big chunk of money from private equity investors in a PIPE (private investment in public equity) round.