Image source: Getty Images

Price volatility is part and parcel of owning BHP Group (LSE:BHP) and cyclical mining shares. At £20.20 per share, the Australian miner has dropped 3% in value over the last year, a period in which wild price swings have been common.

Choppiness on commodity markets has impacted performance of late, as full-year results on Tuesday (19 August) show. But today’s update has also underlined BHP’s robustness, even in the most challenging times.

Here’s why I think the metals giant is a top stock to consider.

Operational strength

Despite the support of a strong copper price, falling iron ore and coal values meant BHP’s revenue dropped 8% in the 12 months to June, to $51.3bn, it said today.

This pulled underlying EBITDA 10% lower, to $26bn.

BHP makes 55% of earnings from iron ore alone. Given this, it’s not surprising that the company’s top and bottom lines dropped year on year.

Yet despite this disappointment, financial 2025 was largely a solid one for BHP. Iron ore output edged 1% higher, to 263m tonnes. But copper was the real star of the show — annual production here rose 8%, coming in above 2m tonnes for the first time.

That’s not all, as BHP also continued to impress on the cost front. Thanks to its low-cost iron ore operations in Western Australia, its group underlying EBITDA margin remained rock solid at 53%. This was down just 1% year on year, despite that much-sharper revenues drop.

Long-term appeal

Today’s update underlines the perils of holding mining stocks. Even businesses with strong operational records can see sales and earnings tumble when commodity prices weaken.

In the last year, BHP shareholders have seen the value of their shares fall. They’ve also endured a sharp cut to the yearly dividend, the total payout dropping 25% in financial 2025 to 110 US cents per share.

But for investors who can stomach such volatility, mining stocks can be excellent long-term investments. In the case of BHP, its share price has more than doubled over the past decade. It has also delivered a steady stream of dividends ($59bn worth since the start of the 2020s alone).

Room for growth

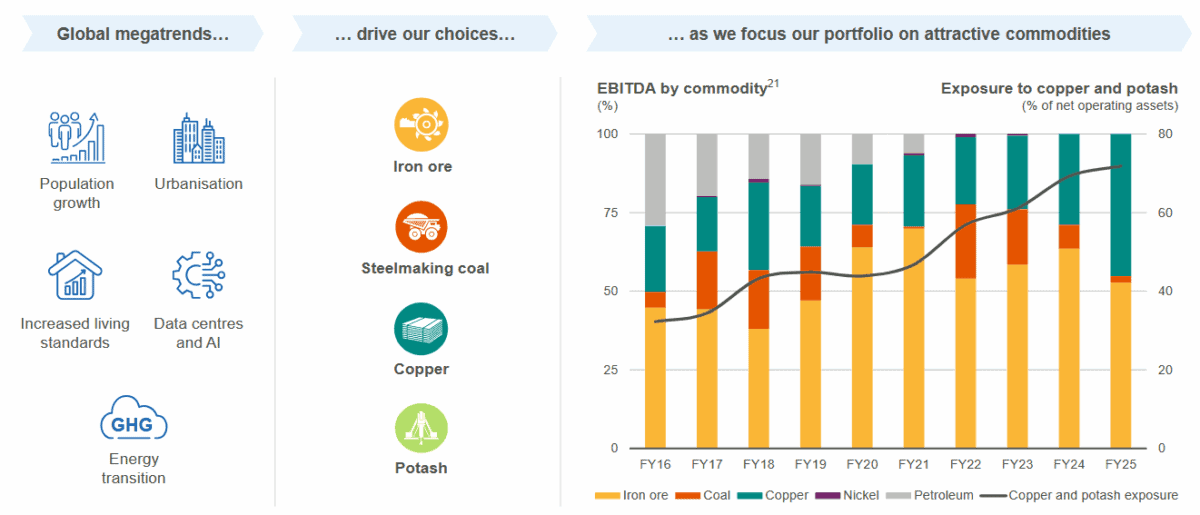

For patient investors, I believe the Aussie miner could remain a lucrative share to hold. This reflects not only the company’s long record of operational robustness. It also has the scale to capitalise on rising metals demand, and is reshaping its portfolio to target fast-growing sectors:

I’m especially encouraged by BHP’s growing role in copper, a segment in which output has risen 28% in the last three years. This is a critical component in multiple industries, including electric vehicles, renewable energy, consumer electronics and information technology.

As red metal demand booms and supply shortages emerge, this alone could be an enormous money spinner for the company.

But it’s not all about copper. I’m also hopeful its major new potash projects will boost long-term earnings, and that ongoing investment in low-cost iron ore will remain a foundation for strong growth.

While not without risk, I think BHP shares are worth serious consideration right now.