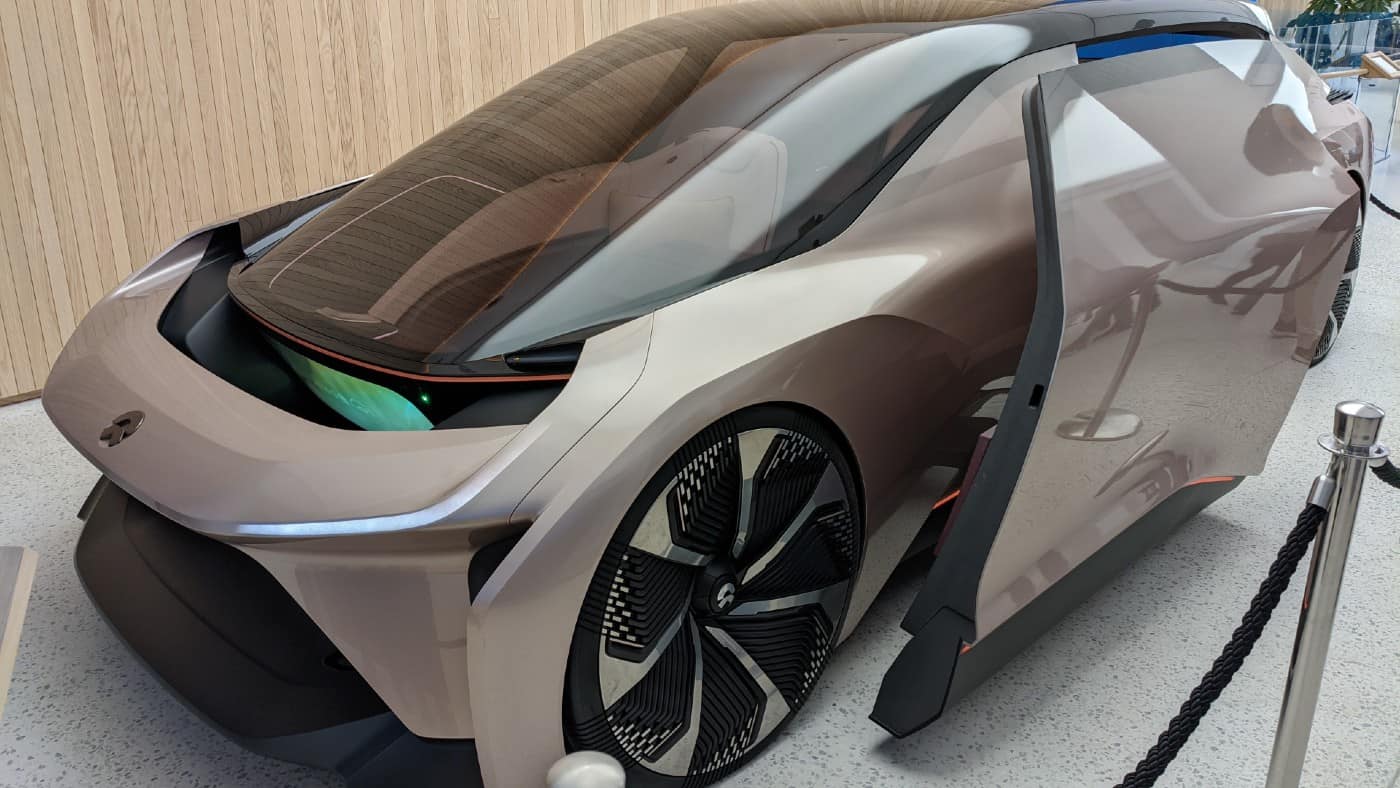

Image source: Sam Robson, The Motley Fool UK

Tesla stock moves around a lot. Over the long term, though, it has been a phenomenon. In the past decade, it is up by 3,097%. I have no plans to invest in Tesla, but ought I to consider picking up some stock in another EV maker, NIO (NYSE: NIO), while it sells for a few dollars apiece?

Yes, the company is smaller than Tesla and loss-making. But a decade ago, Tesla was loss-making too — and much smaller than it is now.

Maybe NIO could end up achieving something similar?

A distinctive niche

As a business, I see a lot to like about NIO.

It has been growing sales and is now a sizeable business. Last year’s vehicle deliveries of 326k represented year-on-year volume growth of 47%.

By contrast, Tesla delivered 1.6m vehicles last year. That actually represented a 9% fall compared to the prior year.

This means that, last year, NIO’s sales volumes were about 20% of Tesla’s (and closing the gap fast), but NIO’s $11bn market capitalisation is less than 1% of Tesla’s $1.4trn market cap.

Sure, NIO does not have the power generation and storage business Tesla does, though its own expertise in battery swapping could help it go down that path if it chose to.

It also has been less vocal about its plans for self-driving taxis and robotics than Tesla, though over time I reckon both companies could pursue that business.

I think NIO has done a better job than Tesla in some markets of developing a moneyed clientele looking for fairly pricey cars.

Given downward pressure on electric vehicle profit margins in recent years, that could give it some cushion compared to rivals.

Does the valuation make sense?

But comparing NIO to Tesla may not be helpful, as personally I think Tesla’s valuation is too high to justify.

One big difference is, as mentioned, NIO remains loss-making and continues to burn through cash.

That is not some small difference, I think it affects the fundamental investment case for the stock.

If I bought now, I would be banking on the car maker turning a profit at some point. But there is no guarantee that will happen.

Strongly rising sales volumes have not yet fed through to the sort of economies of scale and resultant narrowing of losses that I would hope to see as a potential investor.

I reckon NIO continues to have massive potential and that might not be fully reflected in the current stock price. Buying it today could potentially end up being like buying into Tesla a decade ago.

For now, though, I am biding my time. NIO has not yet proved it has a profitable business model. That may come over time – and the stock could soar on the back of it.

But I prefer to see hard evidence of profitability before considering putting a penny into the stock.