Image source: Getty Images

It’s a strange world. FTSE 100 stocks are trading close to their all-time high. And yet the British economy’s slowing, inflation’s rising and most economists are expecting taxes to be increased in November’s Budget.

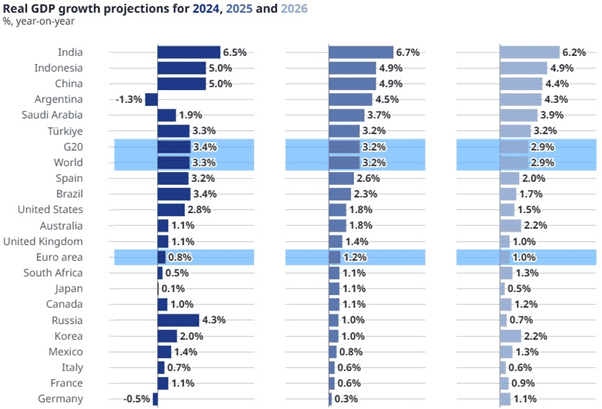

Some of this apparent contradiction can be explained by the international focus of the UK’s largest listed companies. It’s estimated that around 80% of their revenues are earned overseas, which means they’re less reliant on the domestic economy. But the OECD reckons GDP growth in many Western nations is likely to slow over the next year or so.

Also of concern, the Bank of England’s warned that “equity market valuations appear stretched”, particularly in the artificial intelligence (AI) sector. It cautions that there are similarities to the dotcom bubble. And we know how that ended! Even the FTSE 100, notable for its absence of tech stocks, was impacted. At the end of 1999, the index stood at 6,930. By March 2003, it had fallen below 4,000.

A safe haven?

One option available is to consider buying shares in a non-tech stock like Fresnillo (LSE:FRES), the world’s largest silver miner and major gold producer. It operates eight mines in Mexico and owns other exploration projects. Importantly, its level of resources (“quantified, measured, indicated and inferred” gold and silver) has remained broadly the same since the end of 2020.

Mining’s probably the most difficult industry to get right from an operational perspective. Production can be interrupted for all sorts of reasons including accidents, heavy rainfall and unexpected industrial action. It’s also difficult to know — with any accuracy — how much revenue will be generated from a mine’s output as spot prices are determined by global markets.

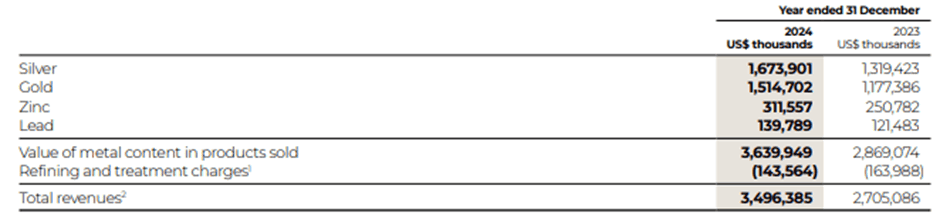

However, the current economic uncertainty is pushing precious metals prices higher. Silver’s just recorded a new all-time high. And gold’s now trading above $4,000 for the first time. Both started to rise during the pandemic and have been steadily increasing ever since.

Understandably, this is helping Fresnillo’s financial performance and its market cap. Its shares are now changing hands for 79% more than they were in October 2020.

What next?

But gold and silver prices can be volatile. And they haven’t always been this high. Ten years ago, they were around a quarter of what they are today. At that time, Fresnillo’s share price was around 70% lower.

Some economists are predicting that prices — particularly gold — will rise further still. Increased central bank demand is seen as one key driver.

Yet even if metals prices don’t rise much more, it seems unlikely to me that there will be a sharp fall any time soon. On this basis, Fresnillo’s stock could be one to consider as a potential hedge against the turbulent times in which we live.

History tells us that a market correction will come, but nobody knows when. With this in mind, I’m going to continue looking for undervalued FTSE 100 stocks, regardless of what’s happening in the wider world. There’s no point trying to time the market. It seems to me that the most successful investors take positions in quality companies and hold them for the long term. That’s what I intend to do.