The moribund housing market has been a headwind for Lowe’s (LOW) over the past few years, but truly long-term investors in the nation’s second-largest home improvement retailer have enjoyed market-beating returns.

Lowe’s and competitor Home Depot (HD) are both contending with higher interest rates, lower home sales and a decline in do-it-yourself (DIY) customers who flocked to their stores during the pandemic.

It’s also hard for a stock like LOW to keep up with a market that’s being driven by outsized returns accruing to Magnificent 7 stocks and other red-hot winners of the AI trade. While the cap-weighted S&P 500 returned more than 18% on a price basis in 2025 – boosted by the likes of Nvidia (NVDA) and Microsoft (MSFT), among others – shares in Lowe’s were up less than 1%.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Lowe’s has also lagged the broader market on an annualized total return basis (price change plus dividends) over the past three-, five- and 10-year periods. The bursting of the housing bubble and our current housing recession did LOW few favors over the past decade.

Buy-and-hold investors are nevertheless sitting on a long-time market beater. Indeed, what started out as a single Southern hardware store more than a 100 years ago has generated impressive outperformance in the 21st century – thanks partly to stiff competition from its No. 1 rival.

Lowe’s operated a chain of traditional hardware stores throughout the Southeast, primarily catering to professional contractors, when Home Depot started invading its turf in the 1980s and 1990s. HD’s big-box retail format and 50-50 split servicing DIY-types and contractors forced Lowe’s to adapt to a new age.

By the turn of the century, Lowe’s had transformed itself into a big-box retailer, too. A company that was growing its revenue year over year at a single-digit percent rate in the early 1990s saw its top line increase at an average annual rate of 18% in the years before the Great Financial Crisis.

Today, Lowe’s is responding to industrywide softness by trying to capture some of HD’s professional contractor business. That’s why the company purchased Foundation Building Materials for $8.8 billion in October 2025. Lowe’s is also pouring resources into its backend technology in order to boost online sales.

Whether the strategy pays off remains to be seen, but if past is prologue, patient investors should be rewarded.

The bottom line on LOW stock?

As mentioned above, LOW stock has been something of a market laggard in the post-pandemic age, hurt by a frozen housing market. Shares trail the performance of the S&P 500 by wide margins over the past three and five years. Over the past 10 years, it’s almost a tie, with LOW stock trailing the broader market by about half a percentage point.

Go farther back, however, and the blue chip stock has been a winner. Heck, over its entire life as a publicly traded company, shares delivered an annualized total return of 18.2% vs 10.8% for the S&P 500.

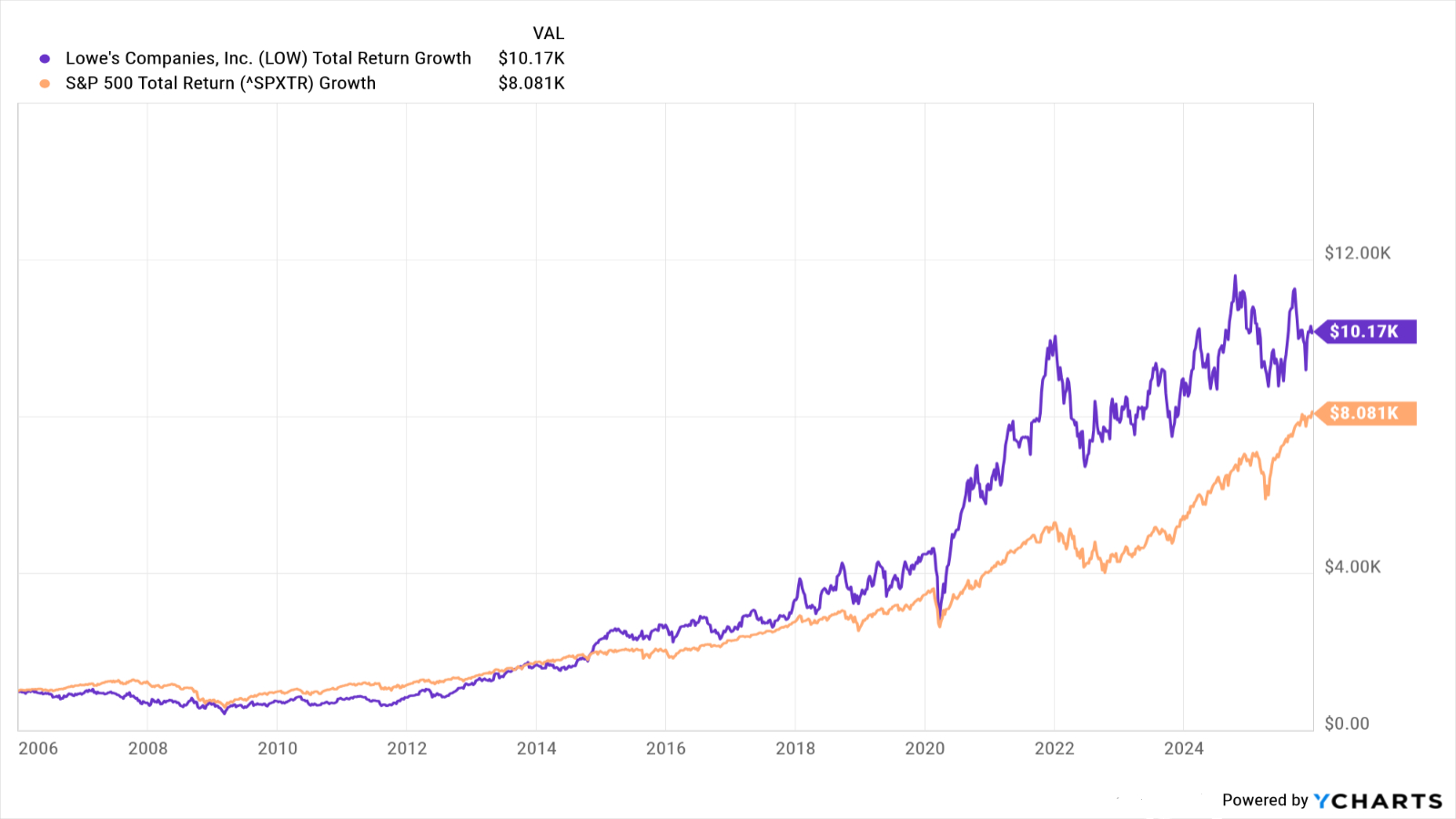

And as for over the more relevant period of the past couple of decades? Have a look at the chart below.

If you put $1,000 into Lowe’s stock 20 years ago, it would today be worth more than $10,000. That’s good for an annualized return of 12.3%. The same sum invested in the S&P 500 would theoretically be worth $8,000 – good for a return of 11%.

Long-time LOW investors also benefited from the company’s commitment to returning cash to shareholders. Thanks to starting from a very low base, Lowe’s has increased its dividend at a compound annual growth rate of 20% over the past two decades. As a member of the S&P 500 Dividend Aristocrats, the home improvement chain is one of the best stocks for dependable dividend growth, having increased its payout annually for more than 50 years.

Wall Street is mostly bullish on the name over the next 12 to 18 months, assigning it a consensus recommendation of Buy, according to S&P Global Market Intelligence. Of the 35 analysts covering LOW, 18 rate it at Strong Buy, three say Buy, 13 call it a Hold and one says Sell.

Speaking for the bulls, Oppenheimer analyst Brian Nagel likes Lowe’s positioning in the sector even as an industrywide rebound remains elusive.

“We look upon LOW as the better way to ‘wait out’ recovery in home improvement, owing to more significant business model slack and a historically discounted share valuation,” notes the analyst, who rates shares at Outperform (the equivalent of Buy).