Tech stocks might get the glory but long-term market beaters can be found in all sorts of places – even the oft-overlooked materials sector. Just take a gander at Sherwin-Williams (SHW).

Believe it or not, shares in the world’s largest paint and coatings company by revenue have been an outstanding buy-and-hold bet for a very long time.

Founded shortly after the Civil War, Sherwin-Williams went on to grow rapidly, especially throughout the 20th century. But it really hit its stride in the 1980s. That’s when a massive expansion of its retail base helped it become as familiar to consumers and do-it-yourself types as enterprise customers and professional contractors.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

However, it’s really been over the past couple of decades that SHW became the blue chip stock that it is today. A slew of acquisitions, capped by its $11 billion deal for Valspar in 2017, massively boosted the company’s portfolio – and, more importantly, its profitability.

Today, SHW is the largest U.S. manufacturer and distributor of paints, coatings and related products, with more than 5,400 retail stores in over 120 countries.

To get a sense of how SHW’s economies of scale impacted its bottom line: a company that posted operating margins of around 14% prior to the Valspar deal now averages closer to 19%. Indeed, over the past five years, revenue grew 26%, while adjusted operating margin increased 31%.

True, Sherwin-Williams’ end markets are highly cyclical, with construction, housing and manufacturing all being sensitive to economic growth and interest rates. Thankfully, a strong commitment to returning cash to shareholders through stock buybacks and dividends helps cushion any ups and downs.

By the way, SHW happens to be one of the best dividend stocks for dependable dividend growth, having increased its payout annually for nearly 50 years.

If there were any doubts about SHW’s blue-chip bona fides, they were laid to rest when the stock was added to the Dow Jones Industrial Average in late 2024. Happily for current shareholders, Sherwin-Williams routinely ranks among analysts’ top Dow Jones stocks.

The bottom line on Sherwin-Williams stock?

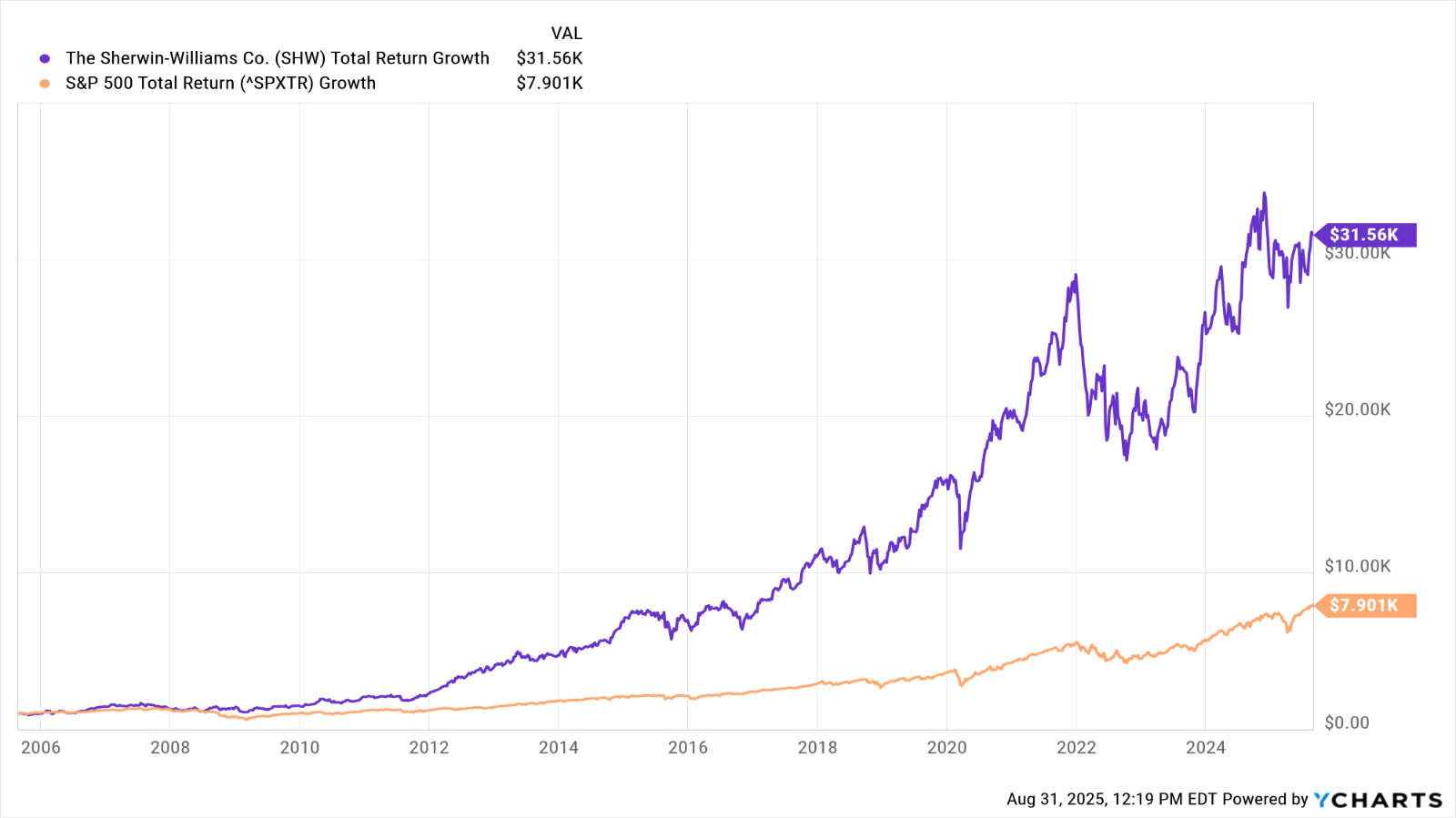

Sherwin-Williams is cyclical. With a beta of more than 1.0, it tends to outperform the S&P 500 in up markets and underperform in down markets. Nevertheless, over most standardized time frames this old economy stalwart has been a winner.

For its entire life as a publicly traded company, SHW has generated an annualized total return (price change plus dividends) of 17%. That beats the S&P 500 by a wide margin, or more than 6 percentage points. SHW also outperforms the market handsomely over the past 10- and 15-year periods.

The more recent past has been a bit tougher, with higher interest rates and other macro factors acting as a drag on the sector. Go back a couple of decades, however, and Sherwin-Williams stock has been a market-beating machine.

As you can see in the above chart, if you put $1,000 into SHW stock 20 years ago, it would today be worth more than $31,000. The same sum invested in the S&P 500 over the same span would theoretically be worth $7,900.

In good news for shareholders and would-be shareholders, Wall Street mostly sees more market-beating returns ahead.

Of the 27 analysts covering SHW surveyed by S&P Global Market Intelligence, 12 call it a Strong Buy, three say Buy, 11 have it at Hold and one rates it at Strong Sell. That works out to a consensus recommendation of Buy, albeit with somewhat mixed conviction.

Speaking for the bulls, Argus Research analyst Alexandra Yates calls the stock a “core long-term holding in the materials sector” based on its leading positions in high-growth end markets.

“We believe that interest rate cuts and moderating inflation will provide a meaningful rebound in real estate demand and serve as a positive catalyst,” writes Yates.