Eric Rivera always knew his retirement would include a house in the mountains of Puerto Rico. So instead of waiting ten or fifteen years until retirement, he went ahead and purchased his dream home while he’s still working.

It doesn’t matter that it means two mortgages. He can still contribute to his 401(k), and although things may be a little tighter, when he does retire, he’ll have two homes that he hopes will have appreciated, along with a plan for where he’ll spend his golden years.

Unconventional? Maybe. After all, the normal trajectory is to save money in a tax-advantaged retirement savings account, retire, and then start your next chapter.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

For Rivera, prepaying a portion of his retirement not only gives him peace of mind but presents an opportunity to pass on generational wealth to his two adult children. When he retires, they’ll inherit his current home, and when he passes, his retirement home.

“Even if I’m wrong, you can’t really put a price on that,” said Rivera. “I already know where I want to retire, and that location may not be affordable to me in ten years.”

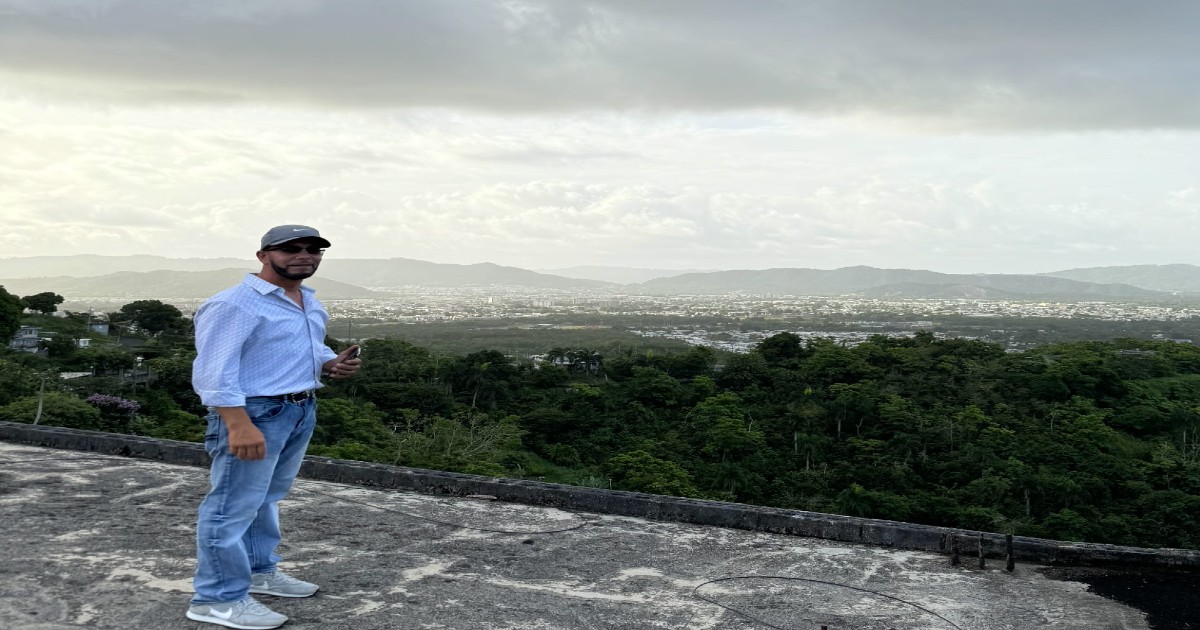

Eric Rivera on the roof of his “dream home” overlooking the mountains of Puerto Rico.

(Image credit: Eric Rivera)

Prepaying retirement dreams

However, it’s not just retirement homes that people are prepaying.

Some people are moving into retirement communities long before they stop working, to prepare for the transition into that phase of their lives.

But the question is, from a wealth planning perspective, is that the best approach? Would their money be better served invested elsewhere?

The answer: It depends.

Prepaying retirement is ok if…

Go for it, says Denny Artache, president and CEO of Artache Financial Group, if the purchase meets certain criteria.

To begin with, you need to be able to afford it. If Rivera had purchased the home in Puerto Rico, but as a result, couldn’t afford his first mortgage, Artache would have said, ‘Don’t do it.’

But Rivera can afford both and plans to have his retirement home paid off before he stops working. At that point, his sons will take over his first mortgage, and he’ll live mortgage-free, alleviating a big financial burden in retirement.

“Whenever you look at ‘Should I?,’ ask yourself, ‘can I afford to?'” says Artache. “Don’t go out of your way to finance a pipe dream.”

The cost of financing and depreciation are other things to consider. If your dream is to travel the country in an RV once you retire in five years, and you want to encourage yourself to do it by buying it ahead of time, the cost of ownership comes into play.

If you have to pay interest on a loan to make it a reality now, or if the RV will be worth nothing when you finally use it, you may be better off waiting. You can save more money to avoid financing charges and get a more modern one later on.

Then there’s the investment returns. In the case of Rivera, he purchased real estate that has the potential to appreciate. That may not be true if you prepaid for a boat or RV.

Some people don’t care if prepaying a piece of their retirement dream isn’t the smartest financial move; for them, it’s about the peace of mind, and that can be priceless.

“If you can afford to have peace of mind, go for it,” says Artache.

Test the waters instead

It’s nice to have a dream and want to prepay for it, but there’s a lot that can go wrong with that, cautions Michael Pumphrey, a wealth advisor at Tanglewood Total Wealth Management.

“One of the big picture things to consider as we guide retirees into the next phase of their life is to have an idea about what retirement might look like, but also that those ideas can change over time,” said Pumphrey.

Rivera may want to live in Puerto Rico now, but who knows if he will still want to in ten years, says Pumphrey. If he changes his mind, he has to deal with trying to sell the property and the potential for losses.

Rather than going all in, Pumphrey advocates a test-the-waters approach in which you take small bites.

“Instead of buying a house in the Caribbean or buying an RV right now, maybe rent an Airbnb or an RV a couple of weeks a year for a few years and see if you like it,” he says. “Even people with these grandiose ideas of how they want to spend all this money decide ‘it isn’t for me.’”

Evaluate your reasons for prepaying

Ultimately, your motivation will dictate why you are prepaying your retirement bucket list item. For Rivera, it’s a desire to retire to a place he always dreamed of and to pass it on to his sons and maybe grandkids, and he’s ok if it doesn’t make him a fortune.

For someone else, it may be less about legacy and the location and more about spending time with family.

“I always say for people to evaluate really what they value, what’s more important to them, and make sure they are prioritizing that in terms of their spending decisions,” said Pumphrey.