Last year, fusion power startup General Fusion was struggling to raise funds, laying off at least 25% of its staff before receiving a $22 million lifeline investment while it figured out how to keep the company afloat.

Today, General Fusion revealed its survival plan: it will go public through a reverse merger with an special purpose acquisition company, Spring Valley III, combined with additional investment from institutional investors. It’s a significant change in fortunes for a company whose CEO wrote a public letter just last year pleading for funding.

If the deal closes as planned, General Fusion could receive up to $335 million from the transaction, more than double what it was reportedly seeking to raise last year before it landed the $22 million lifeline.

The transaction will value the combined company at about $1 billion, General Fusion said. Before the merger was announced. The fusion startup, which was founded in 2002, had previously raised over $440 million, according to PitchBook.

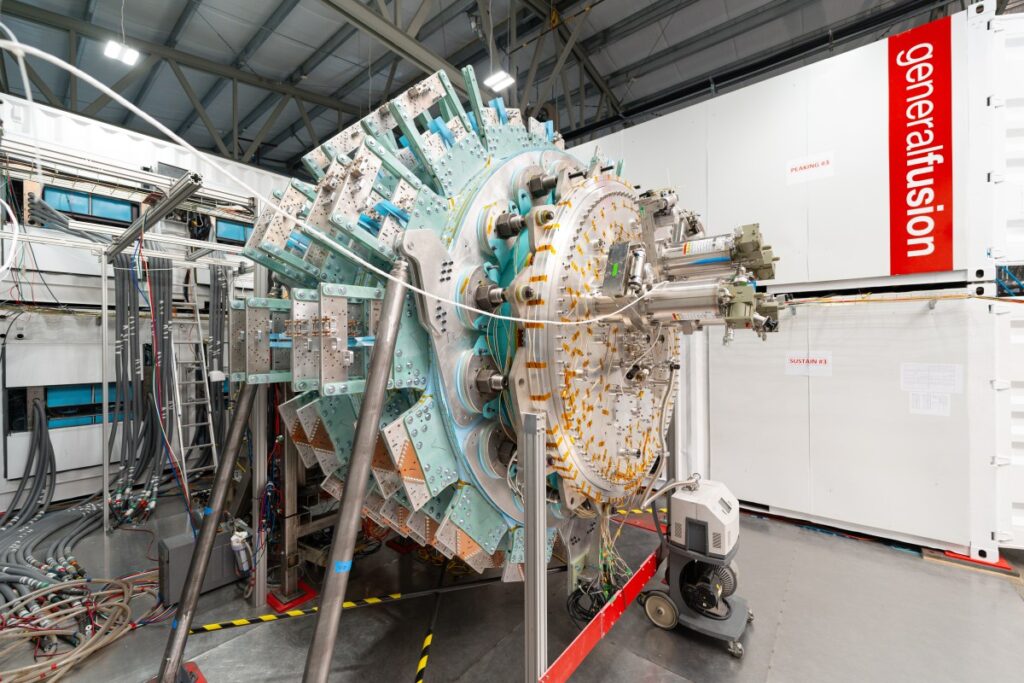

General Fusion plans to use the money to complete its demonstration reactor, Lawson Machine 26 (LM26). The device uses an approach called “inertial confinement,” which works by compressing a fuel pellet until its atoms fuse together, releasing energy in the process. The National Ignition Facility used inertial confinement in its successful fusion experiments, using lasers to bombard the fuel pellets to unleash the compressive force.

LM26 eschews the lasers, though. Instead, it uses steam-driven pistons that drive a wall of liquid lithium metal inward to compress the fuel pellet. That liquid lithium then circulates through a heat exchanger, which generates steam to spin a generator. By avoiding expensive lasers or superconducting magnets, which are required in other fusion reactor designs, General Fusion hopes to build a fusion power plant for less money. But first the company has to prove its approach is viable.

Last year, before it revealed its financial problems, General Fusion said that in 2026, LM26 would hit scientific breakeven, in which a fusion reaction generates more power than was required to start it. Scientific breakeven is a key milestone, though distinct from and easier to attain than commercial breakeven, in which fusion reactions release enough energy to export electricity to the grid. General Fusion did not reply to a request asking if its timeline had change.

Techcrunch event

San Francisco

|

October 13-15, 2026

The acquisition company, Spring Valley, is something of a specialist in reverser mergers with energy companies. It previously took NuScale Power, a small modular nuclear reactor company, public in a deal whose stock price has since fallen more than 50% from its peak last year. The firm is also in the midst of completing a merger with Eagle Energy Metals, a uranium mining company that’s also supposedly developing its own SMR.

General Fusion isn’t the first fusion company to go public. In December, TAE Technologies announced it would merge with Trump Media & Technology Group in a deal valuing the combined company at more than $6 billion.

The common thread connecting these deals is data centers, of course. They’re expected to consume nearly 300% more power by 2035, according to BloombergNEF, and General Fusion explicitly points to rising data center energy demand in its merger announcement.

But the company also pointed to broader electrification trends, including EVs and electric heating, that could increase overall electricity demand by up to 50% by 2035. It’s a reminder that, while the Trump administration has cast doubts on an electrified future, other countries are charging ahead. While General Fusion may face technological challenges, trends in the energy world suggest that if it can deliver fusion power at a reasonable cost, it will find plenty of willing buyers.