(Image credit: Getty Images)

Stocks trended up again during a short Christmas Eve trading session, and the main U.S. equity indexes extended their collective winning streak to five on Wednesday. Both the S&P 500 and the Dow Jones Industrial Average notched new all-time closing highs.

Not a company is stirring on this week’s earnings calendar. Meanwhile, if anything, the economic calendar is giving more reason for our central bankers to pause on cutting interest rates after the conclusion of the next Fed meeting.

The Department of Labor said this morning that initial jobless claims for the week ending December 20 declined by 10,000 to 214,000, below the 224,000 consensus forecast. The four-week moving average declined by 750 to 216,750.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Continuing jobless claims for the week ending December 13 increased by 38,000 to 1,923,000. The four-week moving average declined by 5,250 to 1,893,750.

Price action in the federal funds rate futures market now reflects an 86.7% probability the target range for the Fed’s primary benchmark will remain 3.50% to 3.75% after the January 28-29 Federal Open Market Committee Meeting, up from 75.6% as of December 17.

By Wednesday’s closing bell, the broad-based S&P 500 had added 0.3% to 6,932, extending its winning streak to five and reaching its 39th new all-time closing high this year.

The blue-chip Dow Jones Industrial Average was up 0.6% at 48,731, finishing its fifth straight winning session and making its own new all-time closing high.

The tech-heavy Nasdaq Composite had climbed 0.2% to 23,613 and also extended its winning streak to five heading into the holiday.

Note that the stock and bond markets are closed on Christmas Day.

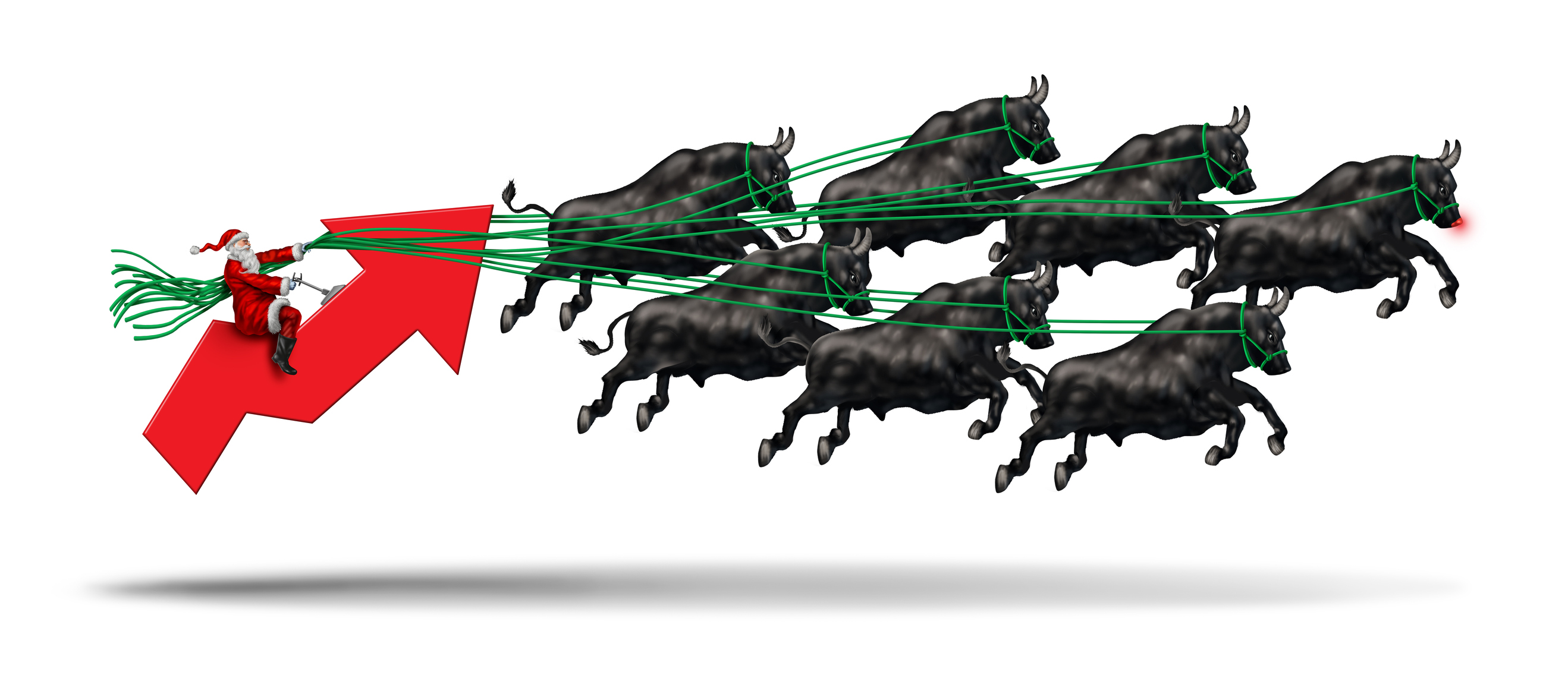

Today is the first day of the Santa Claus Rally

“If Santa Claus should fail to call, bears may come to Broad and Wall,” is, according to his son Jeff, how Yale Hirsch himself explains the increasingly real Santa Claus Rally. As Jeff writes, Yale identified the Santa Claus Rally in 1972 and published his findings in the 1973 edition of the “Stock Trader’s Almanac.”

Here’s the technical definition: “The ‘Santa Claus Rally’ is the last five trading days of the year plus the first two of the new year. This year it begins on the open on December 24 and lasts until the second trading day of 2026, January 5.”

As Jeff Hirsch notes, “Average S&P 500 gains over this seven trading-day range since 1950 are a respectable 1.3%. Failure to have a Santa Claus Rally tends to precede bear markets or times when stocks could be purchased at lower prices later in the year.”

AAPL CEO buys NKE stock

Cook reported to the Securities and Exchange Commission (SEC) that he bought 50,000 shares in the high-profile consumer discretionary stock at an average price of $58.97 on Monday.

A Form 4 filing shows the Apple CEO now owns 105,480 shares of NKE stock. Cook joined Nike’s board in 2005 and has been the lead independent director since 2016.

His recent purchase is being interpreted as a show of support for Nike CEO Elliott Hill, who took over last October 14. Nike rallied on the announcement, but the stock is down more than 20% in 2025.