Image source: Getty Images

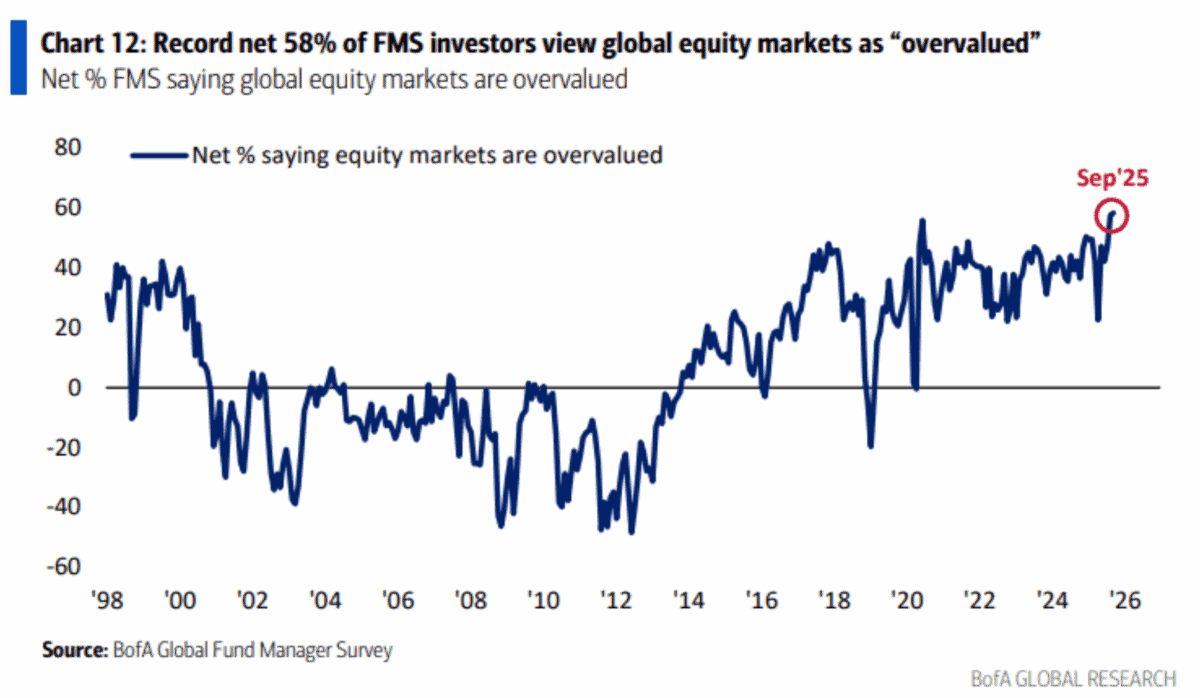

According to the latest data from Bank of America, most hedge fund managers think the global stock market is overvalued right now. And it’s been a long time since they felt this strongly about it.

Not all stocks are the same, though, and large parts of the market don’t look expensive at the moment. But the key for investors is knowing where to look.

Crowded trades

The major investment theme of the year so far has been artificial intelligence (AI). And the most obvious beneficiaries of this have been the collection of stocks known as the ‘Magnificent Seven.’

During the second quarter of this year, the Magnificent Seven collectively grew profits at 26.6%. By contrast, the rest of the S&P 500 managed earnings growth of 7.4%.

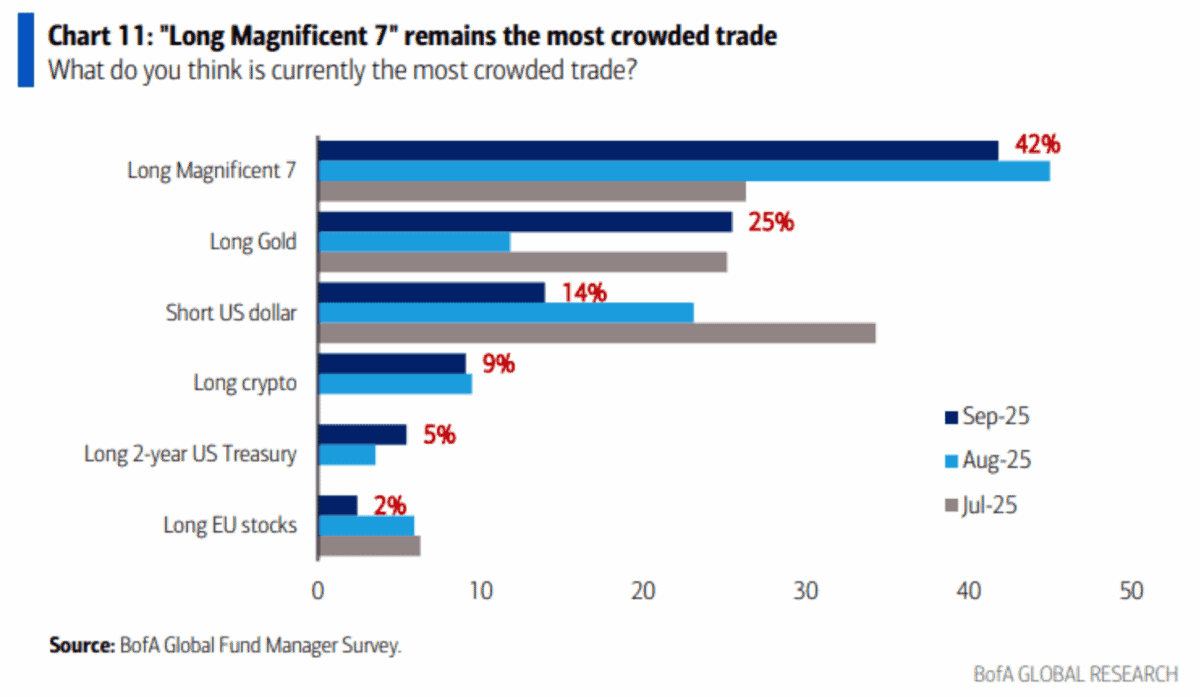

That kind of growth – especially relative to the wider market – has naturally been catching the attention of investors. But fund managers are starting to think the trade is getting crowded.

When investors start doing the same thing, things can get risky. It can lead to sudden reversions in the short term, but there are also long-term issues to consider.

Warren Buffett

When it comes to looking for overlooked opportunities, Warren Buffett is one of the best in the business. And the Berkshire Hathaway CEO has some advice for investors looking to do the same: “The future is never clear – you pay a very high price in the stock market for a cheery consensus. Uncertainty, actually, is the friend of the buyer of long-term values.”

In other words, investors looking for long-term returns should be wary of crowded trades. Instead, they should look for opportunities in places where others are less optimistic.

There are a few of these that spring to mind. But in terms of the S&P 500, there’s one in particular that I think is worth paying attention to at the moment.

Pharmaceuticals

Danaher (NYSE:DHR) shares are down 30% in the last 12 months. And the US administration’s shift in healthcare policy away from medication is a risk that investors should take seriously.

Sales have been falling as a result, but the firm is starting to show signs of recovery. Earnings per share have come in ahead of expectations in both the first two quarters of this year.

Despite a challenging environment, Danaher still has a strong competitive position, which is based on operational efficiency and smart acquisitions. And this is a promising long-term sign.

Source: TradingView

Right now, though, the stock is trading at an unusually cheap level on a price-to-book (P/B) basis. As a result, I think it’s well worth considering as a potential buying opportunity.

Finding opportunities

I think there are always buying opportunities to be found somewhere in the stock market. But as Warren Buffett points out, these are usually not in the places that everyone else is looking.

The rise of AI has resulted in genuine growth for the companies known as the Magnificent Seven. That trade, however, is starting to look crowded and that’s something to be wary of right now.

On the other side, things look less positive in the healthcare space. But with Danaher starting to show some positive signs after a difficult few years, I think this is where investors should look.