Image source: Vodafone Group plc

The Vodafone (LSE:VOD) share price received a bit of a boost on Tuesday (11 November), after the group published its half-year results for the year ending 31 March 2026 (FY26).

Investors sent the telecom giant’s stock 8.3% higher after they reacted positively to the news that the group’s FY26 result is now expected to be at the upper end of guidance.

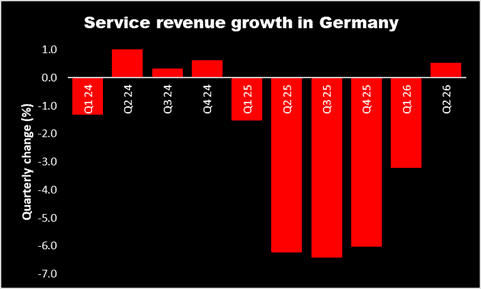

However, more importantly, service revenue in Germany returned to growth during the second three months of the financial year. As the chart below shows, this is the first quarterly increase since the end of FY24.

Hugely important

This is particularly significant given that during the first six months of FY26, the German market accounted for 30.6% of the group’s total revenue and 38.3% of its adjusted EBITDAaL (earnings before interest, tax, depreciation and amortisation, after leases).

This makes it the group’s most important region. And it’s become even more significant given its recent decision to downsize and offload some of its underperforming divisions.

If the recovery in the country’s top line continues – and translates into higher earnings — then it could have a significant impact on Vodafone’s share price. Of all its markets, Germany has the highest profit margin.

Problems in the country stem from the introduction of a new law that prohibited landlords bundling television contracts with rents. The German government viewed this as anti-competitive and introduced legislation to outlaw the move.

But Vodafone says it’s now seen the “final impact of the TV law change”. On hearing the news, Morgan Stanley told its clients: “After roughly 18 months of significant top-line headwinds in the group’s largest market, we view this as a key positive milestone.”

Other activities in Germany include the continuing upgrade of the group’s network to fibre, the introduction of a five-year warranty and further investment to help improve the customer experience. Vodafone claims that it’s “starting to achieve market leadership in specific customer segments”.

The group has also entered into a binding agreement to acquire Skaylink for €175m. It says the purchase will enable its business and public sector customers to “access an enhanced suite of digital services and support”.

One swallow doesn’t make a summer

What’s happening in Germany sounds positive to me. But one quarter’s growth in service revenue is not enough to confirm that a recovery is under way.

And Vodafone continues to face other challenges. The reason for selling some of its assets was to improve its return on capital employed (ROCE). However, during the first six months of FY26, its pre-tax ROCE was unchanged compared to the same period in FY25. This remains a concern.

Also, infrastructure in the telecoms sector is expensive.

Yet Vodafone has made significant progress in addressing its large borrowings. This had been viewed by some investors as a bit of an Achilles heel. On a like-for-like basis, net debt has fallen from €31.8bn at 30 September 2024 to €25.9bn a year later.

And as a sign of confidence, the group said it expects to grow its dividend by 2.5% in FY26. This is the first increase since it announced a 50% cut in May 2024.

For these reasons — along with signs that a recovery in Germany might be under way — I think the stock could be one for long-term investors to consider.