:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-94654181-8f11fff8a72e463a8683c6c7c9ebe896.jpg)

Key Takeaways

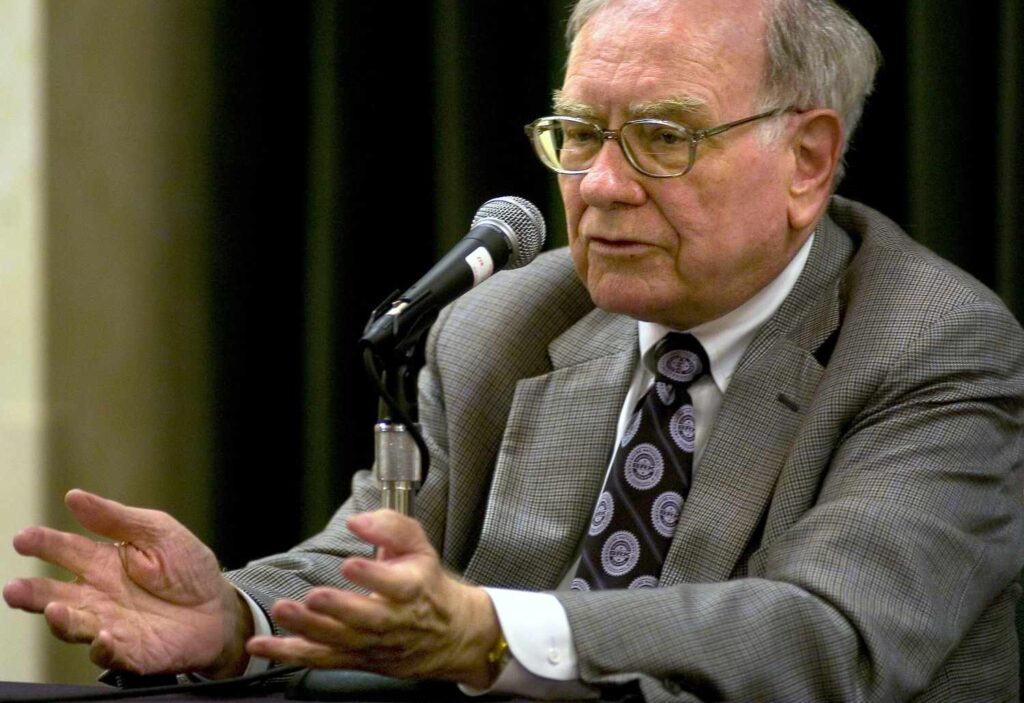

- Warren Buffett has often said that his desired holding period for a stock is “forever.”

- But this can be misinterpreted as holding any stock forever.

- In fact, Buffett restricts this recommendation only to stocks of “great” companies; of businesses he wants to own (and at fair prices).

Buffett’s famous line, “Our favorite holding period is forever,” is widely quoted—but also widely misunderstood. Many naively take it to mean “buy any stock and never sell.” That is not what Buffett meant.

He was talking about core businesses, not just stock tickers. When Buffett buys shares through his holding company, Berkshire Hathaway Inc. (BRK.A, BRK.B), he views them as an ownership stake in a real company with products, customers, employees, and cash flows.

The “forever” quote is about those kinds of businesses Berkshire wants to own, not a blanket instruction to hold on tight to every stock you ever buy.

What Buffett Really Means by “Forever”

The full quote adds some crucial context: “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever,” Buffett once wrote to Berkshire’s shareholders. “There are only a handful of businesses about which we have strong long-term convictions. Therefore, when we find such a business, we want to participate in a meaningful way.”

Berkshire Hathaway aims to buy slices of companies it would happily own permanently, as if it owned the whole business. The idea is simple: if you own a great business at a fair price, your best move is to continue to profit from it and let compounding do the work.

These businesses tend to share three traits:

- Durable competitive advantages (what Buffett calls “moats”) that protect profits and future profitability.

- Trustworthy and competent management that allocates capital wisely and acts like owners.

- The ability to compound earnings by reinvesting profits at attractive returns over many years.

If those long-term fundamentals remain intact, short‑term fluctuations in price are just noise. As such, there’s no reason to sell just because a stock is up or down this year.

Where Investors Go Wrong

Buffett’s quote can easily get stripped of its context and be used to justify behavior Buffett would likely reject.

Indeed, here are some examples of what Buffett does not mean:

- “Never sell, no matter what.” Some investors hold poor or deteriorating businesses because “Buffett said forever.” But he only meant that for great businesses. In reality, he sells when moats weaken, management deteriorates, or better opportunities appear.

- That it applies to low‑quality companies. Similarly, “forever” doesn’t turn a bad or average business into a good investment. Without strong or improving fundamentals, time works against you. Buffett wants great businesses, but he also cares about price versus intrinsic value. Paying any price is just speculation.

- Using “forever” as an excuse for inaction. Long‑term investing doesn’t mean ignoring your portfolio or never revisiting your thesis. It means avoiding unnecessary trading while still monitoring the business. That means rebalancing when position weights change dramatically, and reallocating when the fundamentals do as well.

Tip

Even for Buffett, “forever” is an aspiration, not a hard rule. The goal is to minimize the need to sell by being highly selective about what you buy in the first place.

Buy Businesses, Not Lottery Tickets

A helpful way to read the quote is: “Buy businesses you’d never want to sell if you were the owner.” That mindset is very different from trading symbols on a screen. It means you’re proud to be a part of the company, that you have conviction in its long-term prospects, and that you truly believe the products and services offered are good and valuable.

What does that look like in practice? Buying rarely, when the odds are clearly in your favor, holding through normal volatility and market cycles, and selling when the original reasons you bought no longer apply, the moat erodes, or the price far exceeds reasonable value.