Saving for retirement is essential, but it can feel overwhelming; even some higher earners may fall short. The reality is that those with a workplace 401(k) have a significant advantage in saving. The 57 million employees without a workplace plan not only miss out on employer matching contributions but also lack an easy account to invest in, where contributions are made by default from paychecks.

Those who have had no workplace plans for most of their working life are typically hit the hardest and struggle the most with retirement security. However, losing access to a 401(k) even for a short time late in life can have a significant impact during prime saving years.

This is an issue many older workers face if they are forced out of a secure job too soon, often working part-time or in jobs that offer few benefits and earnings far below their peak.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Whether you’re a young worker who doesn’t have the kind of job that comes with a 401(k) or an older worker struggling to keep up with savings goals, there’s some good news on the horizon. A growing number of states are offering a viable 401(k) alternative, which will come with some additional benefits starting in 2027.

This solution can help if you don’t have a 401(k) at work

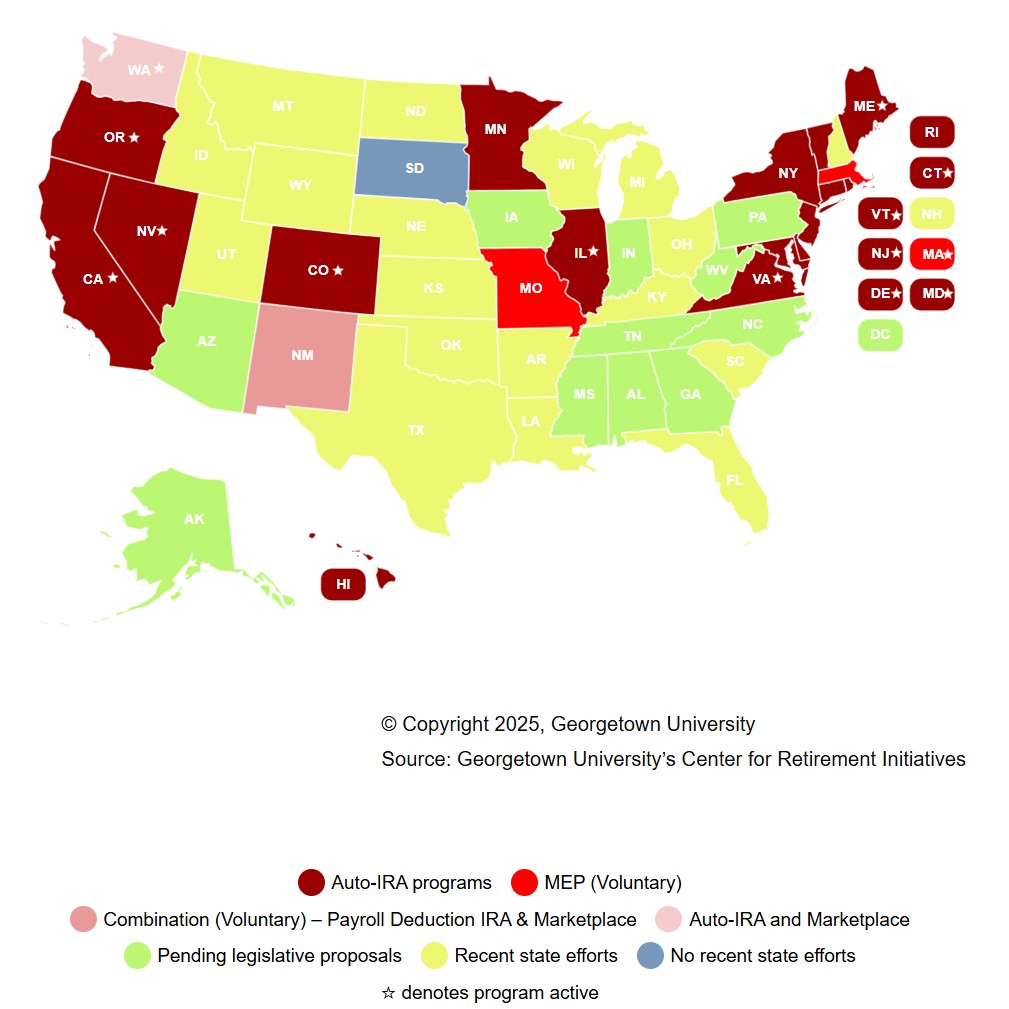

States are often left to pick up the slack when there’s a retirement savings gap, as individuals with too little invested turn to social assistance programs. In an effort to increase retirement savings and reduce reliance on government benefits, 17 states now offer some type of automated individual retirement accounts (auto-IRAs).

While there’s some variation, auto-IRAs generally enroll employees automatically in individual retirement accounts managed by state-approved financial services firms, and automated contributions are collected through payroll deductions.

This happens in much the same way many workplace plans auto-enroll new staff members in 401(k)s, and transfer funds automatically into the company’s 401(k) plan before paychecks are issued.

Auto-IRAs do allow workers to opt out or change their contribution rates, and employers don’t make additional matching contributions as they typically do with 401(k)s. Still, the fact that auto-IRAs make enrollment the default significantly increases the chances of people contributing — and thus improving their retirement readiness.

Participating states are indicated in dark red below. If your state is a different color, you can read more about its efforts to start an auto-IRA or similar program in a summary developed by the Georgetown University Center for Retirement Initiatives. South Dakota is the only state not involved in this type of program. If you live in California, you can take advantage of the new “CalSavvy” chat function to help you navigate the CalSavers program.

(Image credit: Georgetown University, Georgetown Center for Retirement Initiatives, June 2025.)

A federal program may sweeten the pot: Saver’s Match

As most state programs lack matching contributions, there’s less incentive for worker participation, and workers get less support in saving.

That may change in 2027, as a new federal incentive called the Saver’s Match is scheduled to take effect under SECURE 2.0. If it does, the federal government will match up to 50% of contributions to an eligible worker’s IRA or workplace plan, up to a maximum of $1,000 for individuals and $2,000 for couples filing jointly.

The matching funds would be available only to individuals earning $35,000 or less, or couples with an income of $71,000 or less. Contributions begin to phase out once income reaches $20,500 for singles or $41,000 for joint filers.

“Saver’s Match could enhance the retirement savings of millions of low- and moderate-income households,” Pew wrote in a report about the new accounts. This greater opportunity for workers to save for retirement would help them secure their futures, and also ease burdens on state budgets as lawmakers face the demands of an aging population.”

The existence of the match could also prompt people to save more. While 84% of people responding to Pew’s survey expressed initial interest in an auto-IRA program even without the matching funds, this number jumped to 94% when people heard about the Saver’s Match.

That said, the fate of the Saver’s Match is unknown. It’s possible that the Trump administration will decide not to fund the program.

Should you contribute to an auto-IRA?

If your state offers an auto IRA and you’re eligible, contributing to it is a no-brainer.

Regardless of whether the Saver’s Match is implemented and you qualify for it, the reality is that IRA accounts offer numerous benefits, including flexibility in what you invest in.

If you suspect you may qualify for the Saver’s Match, though, it’s important to make sure you don’t lose out. To do that:

- You’ll need to file a federal tax return to claim your match, so be sure to submit a return even if you otherwise wouldn’t

- Adjust your contributions if needed. If you are working a side hustle or doing part-time work, you may not invest enough by default to earn the full Saver’s Match. Try to adjust your contributions up enough so you don’t leave this free money on the table if you are eligible

Whether you are eligible for a Saver’s Match, auto-enrolled in an IRA, or auto-enrolled in a 401(k), you’ll always want to keep tabs on your retirement funds.

It’s up to you to build a secure retirement, so make sure you have a clear idea of your savings goals and that you are on track to achieve them, so you don’t find yourself struggling as a retiree.